You should consider the Fund’s investment objectives, risks, and charges and expenses carefully before you invest. The Prospectus details the Fund’s objective and policies, charges, and other matters of interest to a prospective investor. Please read the Prospectus carefully before investing. The Prospectus may be obtained by visiting the website at fpa.com, by email at [email protected], toll-free by calling 1-800-982-4372 or by contacting the Fund in writing.

Average Annual Total Returns (%)

| As of December 31, 2025 | 40 Yr | 30 Yr | 20 Yr | 15 Yr | 10 Yr | 5 Yr | 3 Yr | 1 Yr | YTD | QTD |

|---|---|---|---|---|---|---|---|---|---|---|

| FPA New Income (FPNIX) | 5.51 | 3.96 | 2.91 | 2.47 | 3.06 | 3.35 | 6.48 | 7.36 | 7.36 | 1.15 |

| Bloomberg U.S. Aggregate | 5.54 | 4.22 | 3.25 | 2.42 | 2.01 | -0.36 | 4.66 | 7.30 | 7.30 | 1.10 |

| CPI + 100 | 3.80 | 3.56 | 3.55 | 3.67 | 4.24 | 5.51 | 3.98 | 3.68 | 3.68 | 0.76 |

| Bloomberg U.S. Aggregate 1-3 Yr | – | – | 2.45 | 1.73 | 2.08 | 1.98 | 4.81 | 5.39 | 5.39 | 1.18 |

Index data source: Morningstar.

Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. This data represents past performance and investors should understand that investment returns and principal values fluctuate, so that when you redeem your investment it may be worth more or less than its original cost. Current month-end performance data, which may be higher or lower than the performance data quoted, may be obtained at fpa.com or by calling toll-free, 1-800-982-4372. As of its most recent prospectus, the Fund’s total expense ratio is 0.59% for the Institutional Class and 0.77% for the Investor Class and net expense ratio is 0.45% for the Institutional Class and 0.55% for the Investor Class.

Periods greater than one year are annualized. FPA New Income Fund (“Fund”) performance reflects the Institutional Class and is calculated on a total return basis which includes reinvestment of all distributions and is net of all fees and expenses. Fund returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares, which would lower these figures. Comparison to any index is for illustrative purposes only. The Fund does not include outperformance of any index or benchmark in its investment objectives. An investor cannot invest directly in an index.

The Fund’s Total Annual Fund Operating Expenses before reimbursement (as of the most recent prospectus) is 0.59% for the Institutional Class and 0.77% for the Investor Class. First Pacific Advisors, LP (“FPA” or the “Adviser”) has contractually agreed to reimburse the Fund for Total Annual Fund Operating Expenses (excluding interest, taxes, brokerage fees and commissions payable by the Fund in connection with the purchase or sale of portfolio securities, and extraordinary expenses, including litigation expenses not incurred in the Fund’s ordinary course of business) in excess of 0.454% of the average daily net assets of the Institutional Class shares of the Fund through January 31, 2027, and in excess of 0.554% of the average daily net assets of the Investor Class shares of the Fund through January 31, 2027. This agreement may only be terminated earlier by the Fund’s Board of Trustees (the “Board”) or upon termination of the Advisory Agreement.

In addition, the Adviser has voluntarily agreed to waive the advisory fee it receives from the Fund by 0.046% through January 31, 2027 of the Fund’s average daily net assets. FPA will not seek recoupment of the advisory fees voluntarily waived.

Please see important disclosures at the end of this commentary.

Dear Shareholder:

FPA New Income Fund (the “Fund”) returned 1.15% in the fourth quarter of 2025 and 7.36% for the year ended December 31, 2025.

| 12/31/2025 | |

|---|---|

| Yield-to-worst1 | 4.00% |

| Effective Duration | 3.22 Years |

| Spread Duration | 2.30 Years |

| High Quality Exposure2 | 96% |

| Credit Exposure3 | 4% |

¹ As of December 31, 2025, the Fund’s subsidized/unsubsidized 30-day SEC standardized yield (“SEC Yield”) was 3.45%/3.31% respectively. The SEC Yield calculation is an annualized measure of the Fund’s dividend and interest payments for the last 30 days, less the Fund expenses. Subsidized yield reflects fee waivers and/or expense reimbursements during the period. Without waivers and/or reimbursements, yields would be reduced. Unsubsidized yield does not adjust for any fee waivers and/or expense reimbursements in effect. The SEC Yield calculation shows investors what they would earn in yield over the course of a 12-month period if the fund continued earning the same rate for the rest of the year.

Yield-to-worst (“YTW”) is presented gross of fees and reflects the lowest potential yield that can be received on a debt investment without the issuer defaulting. YTW considers the impact of expected prepayments, calls and/or sinking funds, among other things. Average YTW is based on the weighted average YTW of the investments held in the Fund’s portfolio. YTW may not represent the yield an investor should expect to receive.

2 High Quality is defined as investments rated A or higher, Treasuries, and cash and equivalents.

3 Credit is defined as investments rated BBB or lower, including non-rated investments.

During the fourth quarter, amid a debate about whether to prioritize reining in inflation or supporting the labor market, the Federal Reserve implemented two consecutive 25-basis point cuts to the Fed Funds Rate. When weighing its dual mandate of managing employment and inflation, the Federal Reserve’s Open Market Committee, which determines monetary policy, concluded that inflation risks had tilted to the upside but the balance of risks had shifted such that the downside risks to employment had risen in recent months, making it appropriate to lower rates to stabilize the labor market. The decision to cut rates in December, however, was marked by significant internal division, and resulted in a 9-3 vote with dissents from officials favoring no rate change at all and one governor advocating for a larger, half-point cut. The lack of a unanimous vote highlights the tension between the Fed’s two mandates and a growing debate within the Committee regarding whether inflation or labor market weakness poses the greater threat to the economy. Treasury yields for one- to five-year maturity bonds decreased slightly during the quarter while yields rose slightly for longer maturity Treasuries. Spreads on investment grade and high yield debt decreased further during the quarter. Because spreads are low, we remain focused on buying longer-duration, High Quality bonds (rated single-A or higher) that we believe will enhance both the Fund’s long-term returns and short-term upside-versus-downside return profile. We seek to opportunistically invest in Credit when we believe prices adequately compensate for the risk of permanent impairment of capital and near-term mark-to-market risk. We did not generally view Credit (investments rated BBB or lower) as attractively priced during the quarter. The Fund’s Credit exposure was 3.6% on December 31, 2025 versus 3.8% on September 30, 2025. Cash and equivalents represented 9.1% of the portfolio on December 31, 2025 versus 7.1% on September 30, 2025.

4Q 2025 Top and Bottom Contributors4

| ▲ Top contributors | Notable drivers of performance |

|---|---|

| Agency mortgage pools | Price increase due to lower benchmark yields and spreads; interest income; and amortization of principal |

| Treasuries | Interest income and price increase due to lower benchmark yields |

| Equipment ABS5 | Interest income and price increase due to lower benchmark yields |

| ▼ Bottom contributors |

|---|

| Although certain individual bonds detracted from performance during the quarter, there were no meaningful detractors at the sector level. |

4 This information is not a recommendation for a specific security or sector and these securities/sectors may not be in the Fund at the time you receive this report. The information provided does not reflect all positions purchased, sold or recommended by FPA during the quarter or calendar year. The portfolio holdings as of the most recent quarter-end may be obtained at fpa.com.

5 Includes COIN 2017-1A A2 which increased in price due to an expected early prepayment.

Calendar Year 2025 Top and Bottom Contributors4

| ▲ Top contributors | Notable drivers of performance |

|---|---|

| Agency mortgage pools | Price increase due to lower benchmark yields and spreads; interest income; and amortization of principal |

| Treasuries | Interest income and price increase due to lower benchmark yields |

| Agency CMBS | Price increase due to lower benchmark yields and spreads; and interest income |

| ▼ Bottom contributors |

|---|

| Although certain individual bonds detracted from performance during the year, there were no meaningful detractors at the sector level. |

Portfolio Activity6

The table below shows the portfolio’s exposures as of December 31, 2025, September 30, 2025 and December 31, 2024:

| 12/31/2025 | 9/30/2025 | 12/31/2024 | |

|---|---|---|---|

| Sector Exposure (% of portfolio) | |||

| ABS | 24.1 | 25.0 | 31.8 |

| CLO | 3.0 | 3.1 | 3.7 |

| Corporate | 3.4 | 3.6 | 4.1 |

| Agency CMBS | 11.9 | 12.4 | 15.1 |

| Non-Agency CMBS | 2.5 | 2.3 | 2.8 |

| Agency RMBS | 21.3 | 22.7 | 19.7 |

| Non-Agency RMBS | 6.1 | 6.4 | 3.7 |

| Stripped Mortgage-backed | 0.3 | 0.3 | 0.3 |

| U.S. Treasury | 18.4 | 17.1 | 13.5 |

| Cash and equivalents | 9.1 | 7.1 | 5.3 |

| Total | 100.0 | 100.0 | 100.0 |

| 12/31/2025 | 9/30/2025 | 12/31/2024 | |

|---|---|---|---|

| Characteristics | |||

| Yield-to-worst7 | 4.00% | 4.14% | 4.86% |

| Effective Duration | 3.22 years | 3.34 years | 3.38 years |

| Spread Duration | 2.30 years | 2.53 years | 2.83 years |

| Average Life | 3.59 years | 3.75 years | 3.91 years |

6 Portfolio composition will change due to ongoing management of the Fund.

7 As of December 31, 2025, the Fund’s subsidized/unsubsidized 30-day SEC standardized yield (“SEC Yield”) was 3.45%/3.31% respectively. The SEC Yield calculation is an annualized measure of the Fund’s dividend and interest payments for the last 30 days, less the Fund expenses. Subsidized yield reflects fee waivers and/or expense reimbursements during the period. Without waivers and/or reimbursements, yields would be reduced. Unsubsidized yield does not adjust for any fee waivers and/or expense reimbursements in effect. The SEC Yield calculation shows investors what they would earn in yield over the course of a 12-month period if the Fund continued earning the same rate for the rest of the year.

Yield-to-worst (“YTW”) is presented gross of fees and reflects the lowest potential yield that can be received on a debt investment without the issuer defaulting. YTW considers the impact of expected prepayments, calls and/or sinking funds, among other things. Average YTW is based on the weighted average YTW of the investments held in the Fund’s portfolio. YTW may not represent the yield an investor should expect to receive.

Past performance is no guarantee, nor is it indicative, of future results.

In the midst of extremely low spreads, we have generally found Credit to be unattractively priced. Sufficient absolute yield is necessary to compensate for credit risk (i.e., the possibility of permanent impairment of capital). However, sufficient spread is also necessary to compensate for the incremental credit risk of debt that is not “risk-free” like Treasuries or debt that is not very high quality like agency mortgages and some AAA-rated bonds, for example. As we have combed the market for investment opportunities, we have discovered that although absolute yields may be appealing in some instances, spreads available in Credit and many esoteric bonds are insufficient to compensate for their credit risk and/or relative illiquidity. Moreover, low spreads increase the odds of incurring short-term drawdowns associated with an increase in spreads. Therefore, in response to low spreads, we have focused our investment activity on High Quality bonds that we believe will offer better liquidity in a risk-off environment and will help mitigate drawdowns that might occur were spreads to increase in such an environment. Specifically, within the High Quality universe we have been buying longer-duration bonds that we believe will improve the long-term return potential of the portfolio and improve the portfolio’s short-term upside-versus-downside return. To that end, during the quarter, in addition to extending the duration of our Treasury holdings, we bought fixed-rate, High Quality bonds with a weighted average life and duration of 4.8 years and 4.3 years, respectively. These High Quality investments included:

- Treasuries

- Utility cost recovery or rate reduction bonds (included within our ABS holdings)

- Non-agency commercial mortgage-backed securities (CMBS)

- Asset-backed securities (ABS) backed by equipment

- Single-family rental bonds (included within our non-agency CMBS holdings)

- Non-agency residential mortgage-backed securities (RMBS)

We sold High Quality ABS, backed by data centers, that had a weighted average life and duration of 1.2 years and reinvested the proceeds in Treasuries with a duration of 4.8 years.

Notwithstanding the longer duration investments we made during the quarter, the duration of the portfolio decreased over the past three months because, as of the end of the quarter, the amount and timing of longer duration investments did not offset the shortening of existing holdings.

We did not make any Credit investments during the quarter.

Observations

Although absolute yields remain high, historically low spreads, in our opinion, have created a very expensive market.

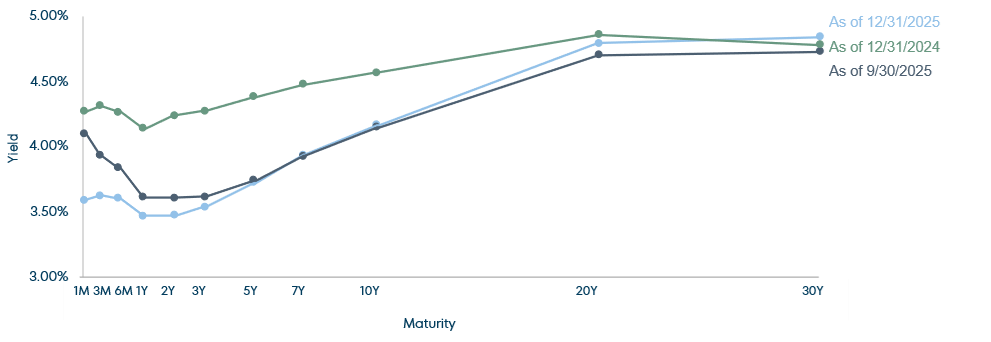

During the quarter, Treasury yields (so called “risk-free” rates) decreased slightly for short to intermediate-maturity bonds and increased slightly for longer maturities. Over the past year, Treasury yields are lower across the yield curve:

U.S. Treasury Yield Curve

Maturity

| Change in yield (bps) | 1Y | 2Y | 3Y | 5Y | 7Y | 10Y | 20Y | 30Y |

|---|---|---|---|---|---|---|---|---|

| Q4 2025 | -14 | -14 | -8 | -2 | 1 | 2 | 9 | 11 |

| Calendar year 2025 | -67 | -77 | -73 | -66 | -54 | -40 | -7 | 6 |

Source: Bloomberg; As of December 31, 2025. Please refer to the end of the commentary for Important Disclosures and definitions of key terms.

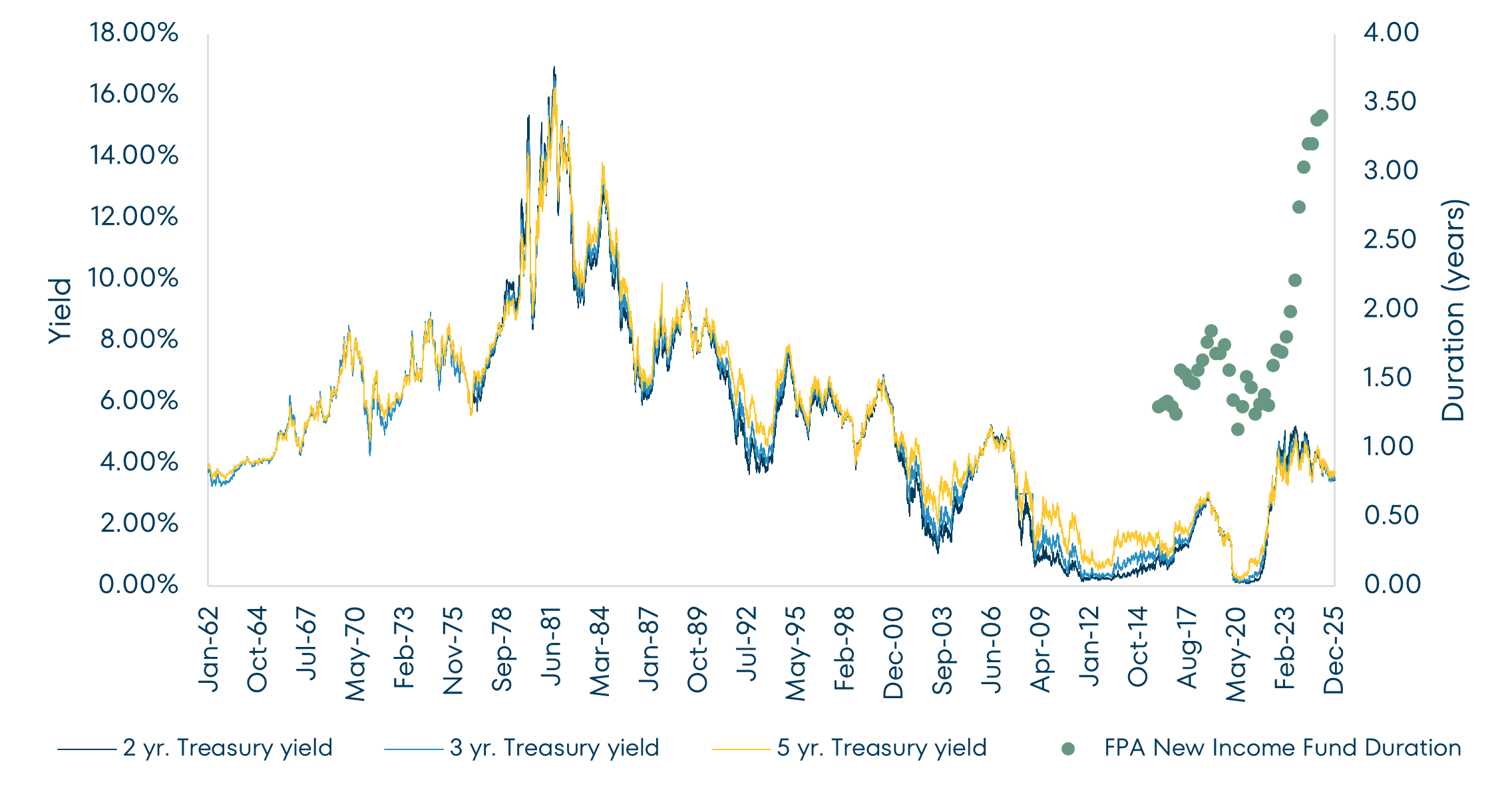

Notwithstanding this decline in yields, Treasury yields are still near 10-15 year highs:

Treasury Yield

Source: Bloomberg. Data from 1/5/1962-12/31/2025. Past performance is no guarantee, nor is it indicative, of future results. Please refer to the end of the commentary for Important Disclosures and Index definitions.

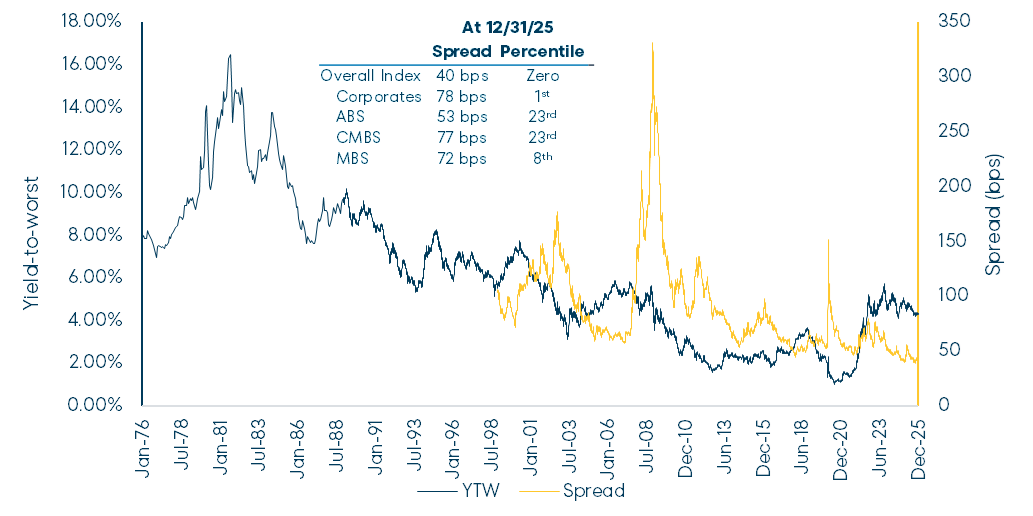

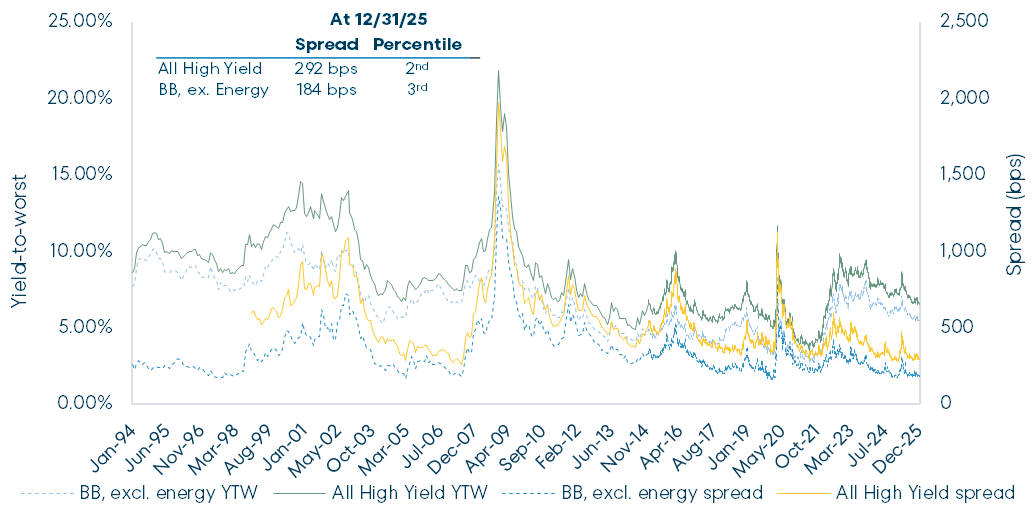

However, spreads on investment grade and high yield debt continued a downward trend that has been ongoing for several quarters, leaving spreads in historically low territory:

Bloomberg U.S. Aggregate Bond Index

Source: Bloomberg. As of December 31, 2025. YTW is Yield-to-Worst. Spread reflects the quoted spread of a bond that is relative to the security off which it is priced, typically an on the run treasury. Past performance is no guarantee, nor is it indicative, of future results. Please refer to the end of the commentary for Important Disclosures and Index definitions.

Bloomberg U.S. Corporate High Yield Index

Source: Bloomberg. As of December 31, 2025. YTW is Yield-to-Worst. Spread reflects the quoted spread of a bond that is relative to the security off which it is priced, typically an on the run Treasury. Past performance is no guarantee, nor is it indicative, of future results. Please refer to the end of the commentary for Important Disclosures and Index definitions.

Historically low spreads have created an historically expensive market. We have been responding by increasing the credit quality of the Fund, as evidenced by the decline in the Fund’s Credit exposure over the past several quarters and the shift toward higher quality holdings such as Treasuries, agency mortgages and AAA-rated bonds in the rest of the portfolio. There are several reasons for this shift:

First, buying debt at spreads that offer insufficient compensation for credit risk increases the risk of permanent impairment of capital due to credit losses. Permanent impairment of capital negatively affects short- and long-term returns. Spreads measure the compensation for taking on credit risk in debt that is not “risk-free”, i.e., Treasuries. Low spreads translate to low compensation for credit risk. In addition to the usual credit risks associated with the characteristics of a particular borrower, these days we face additional risks from federal government policy8 – risks that were not significant throughout the market history shown in the charts above. As noted in our introduction, there is also much uncertainty about the path of the U.S. economy. All things being equal, one would expect more spread to compensate for these additional risks, not less spread, let alone historically low spread. Stated another way, historically low spreads might make sense if one had a very high degree of confidence in a strong economy and business and consumer prospects. As any good debt investor should be, we are downside-focused and not optimistic by nature. Nevertheless, we do not share the optimism, nor do we see the certainty of outcome, needed to justify such low spreads.

Second, the opportunity cost of increasing credit quality is low. Not only are spreads low on an absolute basis, but relative spreads among some types of debt are also low because the market has become less discriminating about risk. For example, as of December 31, the spread on BB-rated high yield bonds, excluding energy, was only 113 bps greater than the spread on investment grade corporate bonds. In a historical context, 113 bps of excess spread is at the third percentile, meaning that 97% of the time this excess spread has been greater than 113 bps. Even within the investment grade universe, incremental spreads are low. For example, BBB-rated bond spreads are 68-71 basis points greater than AAA-rated bond spreads (depending on the measure), which would be the 14th-18th percentile of the available history. We are potentially giving up some extra return by owning higher quality bonds that have less spread but that extra return is historically low. It is important to highlight that we say we are “potentially” giving up some extra return. All things being equal, we are giving up return if spreads do not change or if spreads decrease. Both scenarios seem unlikely to us given that we are starting from historically low levels of spread. In fact, historically, when spreads have been this low, Treasuries and AAA-rated bonds had higher returns than high yield, BBB-rated bonds and even single-A rated bonds over the subsequent 12 months. We choose not to invest based on hope for lower spreads.

Finally, the third reason that we are gravitating toward higher quality bonds is that entry points matter. Buying debt at low spreads increases the likelihood of short-term mark-to-market price declines associated with an increase in spread. The lower the spread, the greater the deviation from historical norms; thus, the greater the potential short-term price decline. The same is true for buying at low yields. Some might say that this mark-to-market risk does not matter for buy-and-hold investors: as long as bonds are held to maturity, it does not matter if changes in spread cause bond prices to fluctuate in the interim. The problem with that argument is that buy-and-hold investors may eventually see the dollar value of their fixed income investments recover to their cost basis as maturity approaches but, depending on the severity of the price decline, recovery can take a long time. Therefore, not only is a return of capital delayed but a return on capital is lost. In general, paying high prices for investments can lead to capital destruction versus the alternative of being mindful of entry points.

For example, using the Bloomberg High Yield Index as a proxy, investors who paid peak prices for high yield in 2020-2021 would have had to wait two years to recover the value of their cost basis following the yield- and spread-induced selloff that occurred in 20229. Using the Bloomberg Aggregate Bond Index as a proxy, investors who paid peak prices for investment grade debt in 2020-2021 would still not have recovered their cost basis as of December 31, 202510. Over the five years from December 31, 2020 to December 31, 2025, the Bloomberg Aggregate Bond Index lost a cumulative -1.81%, or -0.36% annualized.

We try to be thoughtful about short-term mark-to-market risk because we believe long-term returns benefit from taking advantage of short-term mark-to-market price declines rather than being burdened by such price declines. Indeed, whereas the Bloomberg Aggregate Bond Index has lost money over the past five years, the Fund has returned a total of 17.94% during that time, or 3.35% annualized. The Fund also outperformed the 1-3 Yr. Aggregate Bond Index which returned 10.29% over this period (1.98% annualized), and the Morningstar short duration category which returned 2.24% annualized. We highlight these short duration comparisons to underscore that even within the short duration universe, entry points matter. In short, being mindful of entry points can produce better returns on capital over time.

For these reasons, we have been leaning toward High Quality debt and, as we have done so, we have focused those investments on longer duration bonds identified by our 100 bps duration test. That test identifies the longest-duration bonds that we expect will produce at least a breakeven return over a 12-month period, assuming a bond’s yield will increase by 100 bps during that period. The chart below illustrates our duration test.

8 Notable among these risks is the possible loss of Federal Reserve independence; risks associated with the federal government choosing winners and losers among American businesses, state and local governments, consumers, etc.; and geopolitical risks which can induce “sell America” capital flows that can make capital unavailable or prohibitively expensive.

9 The index value of the Bloomberg High Yield Index peaked at 2,461 in December 2021 and recovered to 2,480 by December 2023.

10 The index value of the Bloomberg Aggregate Bond Index peaked at 2,392 in December 2020. The index value as of December 31, 2025 was 2,349.

Hypothetical 12-Month U.S. Treasury Returns

As of December 31, 2025. Source: Bloomberg. ¹ Yield-to-maturity is the annualized total return anticipated on a bond if the bond is held until it matures and assumes all payments are made as scheduled and are reinvested at the same yield. ² Downside return estimates the 12-month total return assuming yields increase by 100 bps over 12 months. Upside return estimates the 12-month total return assuming yields decline by 100 bps over 12 months. Return estimates assume gradual change in yield over 12 months. The hypothetical stress test data provided herein is for illustrative and informational purposes only and is intended to demonstrate the mathematical impact of a hypothetical change in Treasury yields on Treasury returns. This data is not, and is not intended to be representative of the Fund’s returns. No representation is being made that any account, product or strategy will or is likely to achieve profits, losses, or results similar to those shown. Past performance is no guarantee, nor is it indicative, of future results. Please refer to the back of the commentary for important disclosures.

The dark blue bars above show Treasury yields of various maturities as of December 31, 2025. The green bars show the results of our duration test and represent the potential short-term downside return for these bonds in a rising interest rate environment. For example, the 5-year Treasury purchased at a 3.73% yield was expected to return 0.12% over twelve months if its yield increased by 100 bps from 3.73% to 4.73% during that time. Because the expected short-term downside return was positive, the 5-year Treasury and other bonds with a similar duration were candidates for our portfolio. The 7-year Treasury was not a candidate for our portfolio at that time because it produced an expected short-term loss.

Our 100 bps test attempts to build into each of our investments some ability to preserve capital should interest rates rise because of higher inflation, stronger economic growth, loss of Federal Reserve independence, geopolitics-induced capital flight from the U.S., or fiscal concerns, just to name a few possible drivers of higher rates. On the other hand, weaker economic growth, increased productivity, disinflation, preservation of Federal Reserve independence, or geopolitical calm – again, just to name a few possibilities – could lead to lower interest rates. The light blue bars on the chart above indicate the short-term upside return potential over twelve months if rates decreased by 100 bps. In the example above, the 5-year Treasury offered a potential 12-month total return of 7.49%.

Guided by our duration test, we have been buying longer duration bonds for the past few years. It turned out that interest rates declined in 2025 and the Fund realized the upside optionality built into our longer duration investments, propelling the Fund to class-leading returns in 2025. To be clear, the Fund’s duration-driven returns in 2025 do not represent a bet on interest rates that we got “right.” Rather, we intentionally bought optionality on lower rates and the option value materialized. Alternatively, rates could have increased and we would have also been happy with that outcome because we purchased some ability to preserve capital in a rising rate environment via our 100 bps test. In that rising interest rate scenario, we would expect the principal value of the portfolio to remain largely intact, and we would then face a market of cheaper, higher yielding bonds available to us. In fact, that is what happened in 2024, and we reaped the benefits in 2025. Going forward, as was true in the past, the Fund is not geared toward interest rates moving one way or the other. Like last year and years prior, the Fund is instead constructed with downside protection11 and upside optionality.

Throughout the Fund’s history, we have been mindful of valuations and entry points. Our investment process responds to market prices instead of trying to anticipate them. We use current market prices to manage credit risk, exposure to spread and duration risk. This approach drove the Fund’s performance in 2025 and the Fund’s class-leading returns over longer horizons as well. Moreover, the Fund has also produced better absolute and risk-adjusted returns than longer duration alternatives (as represented by the Bloomberg Aggregate Bond Index) with much less volatility:

11 Downside protection refers strictly to a strategic investment goal and is not meant to imply any guarantee against loss, including the loss of the entire principal amount invested.

FPA New Income Annualized and Risk-adjusted Returns

| 1 Yr | 3 Yr | 5 Yr | 10 Yr | 15 Yr | |

|---|---|---|---|---|---|

| Annualized Return | |||||

| FPA New Income (FPNIX) | 7.36% | 6.48% | 3.35% | 3.06% | 2.47% |

| Morningstar U.S. Fund Short-Term Bond Percentile Rank | 5 | 9 | 7 | 13 | 24 |

| Bloomberg U.S. Aggregate | 7.30% | 4.66% | -0.36% | 2.01% | 2.42% |

| Sortino Ratio | |||||

| FPA New Income (FPNIX) | 4.25 | 0.86 | -0.02 | 0.55 | 0.80 |

| Morningstar U.S. Fund Short-Term Bond | 3.91 | 0.44 | -0.55 | 0.11 | 0.41 |

| Bloomberg U.S. Aggregate | 2.11 | -0.03 | -0.71 | -0.04 | 0.31 |

Source: Morningstar Direct. As of December 31, 2025. Performance shown is for the Institutional Class shares (“FPNIX”). FPNIX performance is net of all fees and expenses and includes the reinvestment of distributions. This data represents past performance and investors should understand that investment returns and principal values fluctuate, so that if you redeem your investment in the Fund it may be worth more or less than its original cost. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. Lower Morningstar category percentile ranks indicate outperformance relative to peers in the same Morningstar category. Current month-end performance data for FPNIX, which may be higher or lower than the performance data quoted, may be obtained at fpa.com or by calling toll-free, 1-800-982-4372. FPNIX’s net expense ratio as indicated in its most recent prospectus is 0.45%. Please refer to the end of the commentary for Important Disclosures and a Glossary of Terms.

We enter 2026 with a higher quality, longer duration portfolio than many of our peers. Our positioning may be viewed as contrarian. This would not be the first time that we have veered from the crowd. Indeed, differentiated positioning is a feature of our investment process. We recognize that there may be a cost to our investment posture in the short-term, but we have decades of proof across our fixed income strategies that paying attention to valuations pays off for our investors in the long-term.

Thank you for your confidence and continued support.

Note Regarding Capacity

We are sensitive to the negative impact that substantial asset size, flows (in or out) and/or the timing of those flows can have on the management and performance of a portfolio. We view capacity in relation to the opportunity set: our investment strategies have more capacity when the opportunity set is larger and less capacity when the opportunity set is smaller. In mid-2020, we proactively soft-closed the FPA New Income Fund because of the fund’s size and significant asset growth at a time when market yields were near zero. It was clear to us then that welcoming new investors into FPA New Income would be detrimental to our existing investors.

Recently, we have seen meaningful asset growth in FPA New Income and FPA Flexible Fixed Income. While absolute market yields are attractive, credit spreads have compressed to historically low levels thereby making the opportunity set less attractive. Though we believe that both funds have significant additional capacity, absent any changes in the market, we are getting closer to capacity. Both funds remain open for now but, in the interest of optimizing returns for our existing investors, we have proactively decided to be more selective in marketing to new investors in the Funds and are no longer actively seeking new institutional separate account relationships.

Abhijeet Patwardhan

Portfolio Manager

February 2026

Important Information

This Commentary is for informational and discussion purposes only and does not constitute, and should not be construed as, an offer or solicitation for the purchase or sale of any securities, products or services discussed, and neither does it provide investment advice. Any such offer or solicitation shall only be made pursuant to the Fund’s Prospectus, which supersedes the information contained herein in its entirety.

The views expressed herein and any forward-looking statements are as of the date of the publication and are those of the portfolio management team. Future events or results may vary significantly from those expressed and are subject to change at any time in response to changing circumstances and industry developments. This information and data has been prepared from sources believed reliable, but the accuracy and completeness of the information cannot be guaranteed and is not a complete summary or statement of all available data. You should not construe the contents of this document as legal, tax, accounting, investment or other advice or recommendations.

Abhijeet Patwardhan has been portfolio manager for the Fund since November 2015. Thomas Atteberry managed/co-managed the Fund from November 2004 through June 2022. Effective July 1, 2022, Mr. Atteberry transitioned to a Senior Advisory role. There were no material changes to the investment process due to this transition. Effective September 30, 2023, Mr. Atteberry no longer acts as a Senior Advisor to the investment team, but he remains as Senior Advisor to FPA.

Portfolio composition will change due to ongoing management of the Fund. References to individual securities or sectors are for informational purposes only and should not be construed as recommendations by the Fund, the portfolio manager, the Adviser, or the distributor. It should not be assumed that future investments will be profitable or will equal the performance of the security or sector examples discussed. The portfolio holdings as of the most recent quarter-end may be obtained at fpa.com.

The statements made herein may be forward-looking and/or based on current expectations, projections, and/or information currently available. Actual results may differ from those anticipated. The portfolio manager and/or FPA cannot assure future results and disclaims any obligation to update or alter any statistical data and/or references thereto, as well as any forward-looking statements, whether as a result of new information, future events, or otherwise. Such statements may or may not be accurate over the long-term.

Investments carry risks and investors may lose principal value. Capital markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. The Fund may purchase foreign securities, including depository receipts, which are subject to interest rate, currency exchange rate, economic and political risks; these risks may be elevated when investing in emerging markets. Foreign investments, especially those of companies in emerging markets, can be riskier, less liquid, harder to value, and more volatile than investments in the United States. The securities of smaller, less well-known companies can be more volatile than those of larger companies.

The return of principal in a bond fund is not guaranteed. Bond funds have the same issuer, interest rate, inflation and credit risks that are associated with underlying bonds owned by the Fund. Lower rated bonds, convertible securities and other types of debt obligations involve greater risks than higher rated bonds.

Interest rate risk is the risk that when interest rates go up, the value of fixed income instruments, such as bonds, typically go down and investors may lose principal value. Credit risk is the risk of loss of principal due to the issuer’s failure to repay a loan. Generally, the lower the quality rating of a fixed income instrument, the greater the risk that the issuer will fail to pay interest fully and return principal in a timely manner. If an issuer defaults, the fixed income instrument may lose some or all of its value.

Mortgage securities and collateralized mortgage obligations (CMOs) are subject to prepayment risk and the risk of default on the underlying mortgages or other assets; such derivatives may increase volatility. Convertible securities are generally not investment grade and are subject to greater credit risk than higher-rated investments. High yield securities can be volatile and subject to much higher instances of default.

Collateralized debt obligations (“CDOs”), which include collateralized loan obligations (“CLOs”), collateralized bond obligations (“CBOs”), and other similarly structured securities, carry additional risks in addition to interest rate risk and default risk. This includes, but is not limited to: (i) distributions from the underlying collateral may not be adequate to make interest or other payments; (ii) the quality of the collateral may decline in value or default; and (iii) the complex structure of the security may not be fully understood at the time of investment and may produce disputes with the issuer or unexpected investment results. Investments in CDOs are also more difficult to value than other investments.

Value style investing presents the risk that the holdings or securities may never reach their full market value because the market fails to recognize what the portfolio management team considers the true business value or because the portfolio management team has misjudged those values. In addition, value style investing may fall out of favor and underperform growth or other styles of investing during given periods.

The ratings agencies that provide ratings are Standard and Poor’s (“S&P”), Fitch, Moody’s, Kroll, DBRS, and any other nationally recognized statistical rating organization (“NRSRO”). Credit ratings range from AAA (highest) to D (lowest). Bonds rated BBB or above are considered investment grade. Credit ratings of BB and below are lower-rated securities (junk bonds). High-yielding, non-investment grade bonds (junk bonds) involve higher risks than investment grade bonds. Bonds with credit ratings of CCC/Caa or below have high default risk. Please refer to the Fund’s Prospectus for a complete overview of the primary risks associated with the Fund.

The Fund is not authorized for distribution unless preceded or accompanied by a current prospectus. The prospectus can be accessed at: https://fpa.com/request-funds-literature.

Hypothetical Stress-Tested Result

The hypothetical and estimated data provided herein is for illustrative and informational purposes only. No representation is being made that Fund or the securities used for the simulation will or is likely to achieve profits, losses, or results similar to those shown. Hypothetical and estimated results do not reflect trading in actual accounts, and do not reflect the impact that economic, market or other factors may have on the management of the account.

The hypothetical and estimated results as set forth in this commentary do not represent actual results; actual results may significantly differ from the theoretical data being presented. Hypothetical/estimated results have certain inherent limitations. Hypothetical models theoretically may be changed from time to time to obtain more favorable results. There may be sharp differences between simulated or estimated results and the actual results subsequently achieved by any particular security, account, product or strategy. In addition, simulated/estimated results cannot account for the impact of certain market risks such as a lack of liquidity or default risk. There are numerous other factors related to the markets in general or the implementation of any specific strategy which cannot be fully accounted for in the preparation of simulated or estimated results, all of which can adversely affect actual results.

A client’s individual portfolio results may vary from any hypothetical or estimated results because of the timing of trades, deposits and withdrawals, the impact of management fees and taxes, market fluctuations, trading costs, cash flows, custodian fees, among other factors. Hypothetical results are not meant to be construed as a prediction of the future return of the Fund. Past performance is no guarantee, nor is it indicative, of future results.

Index Definitions

Comparison to any index is for illustrative purposes only and should not be relied upon as a fully accurate measure of comparison. The Fund will be less diversified than the indices noted herein and may hold non-index securities or securities that are not comparable to those contained in an index. Indices will hold positions that are not within the Fund’s investment strategy. Indices are unmanaged, do not reflect any commissions, fees or expenses which would be incurred by an investor purchasing the underlying securities. The Fund does not include outperformance of any index or benchmark in its investment objectives. Investors cannot invest directly in an index

Bloomberg U.S. Aggregate Bond Index provides a measure of the performance of the U.S. investment grade bonds market, which includes investment grade U.S. Government bonds, investment grade corporate bonds, mortgage pass-through securities and asset-backed securities that are publicly offered for sale in the United States. The securities in the Index must have at least 1 year remaining in maturity. In addition, the securities must be denominated in U.S. dollars and must be fixed rate, nonconvertible, and taxable.

Bloomberg U.S. Aggregate 1-3 Year Bond Index provides a measure of the performance of the U.S. investment grade bonds market, which includes investment grade U.S. Government bonds, investment grade corporate bonds, mortgage pass-through securities and asset-backed securities that are publicly offered for sale in the United States. The securities in the Index must have a remaining maturity of 1 to 3 years. In addition, the securities must be denominated in U.S. dollars and must be fixed rate, nonconvertible, and taxable.

Bloomberg U.S. Corporate High Yield Bond Index measures the market of USD-denominated, non-investment grade, fixed-rate, taxable corporate bonds.

Bloomberg U.S. Investment Grade Corporate Index measures the investment grade, fixed-rate, taxable corporate bond market. It includes USD denominated securities publicly issued by US and non-US industrial, utility, and financial issuers.

Consumer Price Index (CPI) is an unmanaged index representing the rate of the inflation of the U.S. consumer prices as determined by the U.S. Department of Labor Statistics. This index reflects non-seasonally adjusted returns. There can be no guarantee that the CPI or other indexes will reflect the exact level of inflation at any given time.

CPI +100 Basis Points is created by adding 1% to the annual percentage change in the Consumer Price Index (“CPI”).

Merrill Lynch Option Volatility Estimate (MOVE) Index reflects the level of volatility in U.S. Treasury futures. The index is considered a proxy for term premiums of U.S. Treasury bonds (i.e., the yield spread between long-term and short-term bonds).

Morningstar Short-Term Bond portfolios invest primarily in corporate and other investment-grade U.S. fixed-income issues and typically have durations of 1.0 to 3.5 years. These portfolios are attractive to fairly conservative investors, because they are less sensitive to interest rates than portfolios with longer durations. Morningstar calculates monthly breakpoints using the effective duration of the Morningstar Core Bond Index in determining duration assignment. Short-term is defined as 25% to 75% of the three-year average effective duration of the MCBI. As of December 31, 2025, there were 559funds in the category.

Glossary of Terms

ABS (Asset Backed Securities) are financial securities backed by a loan, lease or receivables against assets other than real estate and mortgage-backed securities.

Average Life (years) is the average length of time that each dollar of unpaid principal on a loan, a mortgage or an amortizing bond remains outstanding.

Basis Point (bps) is equal to one hundredth of one percent, or 0.01%. 100 basis points = 1%.

CLO (Collateralized Loan Obligation) is a single security backed by a pool of debt.

CMBS (Commercial Mortgage Backed Security) is a mortgage-backed security backed by commercial mortgages rather than residential mortgages.

Credit is defined as investments rated BBB or lower, including non-rated investments.

Effective Duration measures the sensitivity of the price to changes in interest rates, incorporating the impact of changes in interest rates on call options and expected cashflows. Calculations for the Fund exclude equity holdings.

A fixed rate bond is a bond that pays the same level of interest over its entire term.

Floating-rate security, also known as a “floater”, is an investment with interest payments that float or adjust periodically based upon a predetermined benchmark.

High Quality is defined as investments rated A or higher, Treasuries, and cash and equivalents.

Risk-free rate of return is the theoretical rate of return of an investment with zero risk. The risk-free rate represents the interest an investor would expect from an absolutely risk-free investment over a specified period of time.

RMBS (Residential Mortgage Backed Securities) are mortgage-backed securities backed by residential mortgages.

Spread Duration is the sensitivity of the price of a security to changes in its credit spread. The credit spread is the difference between the yield of a security and the yield of a benchmark rate, such as a cash interest rate or government bond yield. Calculations for the Fund exclude equity holdings.

©2026 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted by Morningstar to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

The FPA Funds are distributed by Distribution Services, LLC. 190 Middle Street, Suite 301, Portland, ME 04101. Distribution Services, LLC and FPA are not affiliated.