Dear Shareholder:

Performance Overview

Source Capital’s (“Source” or “Fund”) net asset value (NAV) gained 6.70% for the quarter and 12.24% for the trailing twelve months, which is higher than the balanced MSCI ACWI/Bloomberg US Agg index, the Fund’s primary illustrative benchmark, for the trailing twelve months.

Performance versus Illustrative Indices (%)1

| Return | Yield* | ||

|---|---|---|---|

| Q2 2025 | Trailing 12-month | ||

| Source Capital – NAV | 6.70 | 12.24 | 5.44 |

| 60% MSCI ACWI / 40% BBG US Agg | 7.34 | 11.35 | 2.79 |

| 60% S&P 500 / 40% BBG US Agg | 7.02 | 12.75 | 2.52 |

The Fund’s risk exposure is fairly balanced between Equities and Credit, as reflected in the following table.

Portfolio Exposure (%)2

| Q2 2025 | |

|---|---|

| Equity | |

| Common Stocks | 41.0 |

| Total Equity | 41.0 |

| Credit | |

| Public | 18.2 |

| Private (invested assets only) | 20.1 |

| Total Credit | 38.3 |

| Other Limited Partnerships | 3.9 |

| Other | 0.0 |

| Cash and Equivalents | 16.8 |

| Total | 100 |

¹ Comparison to the indices is for illustrative purposes only. An investor cannot invest directly in an index. Fund shareholders may only invest or redeem their shares at market value (NYSE: SOR), which may be higher or lower than the Fund’s net asset value (NAV).

* Source: FPA, FactSet, Bloomberg. As of June 30, 2025. The “yield” shown for the Fund is the NAV distribution yield (also referred to as the Fund’s “distribution rate” as a % of NAV). Dividend yield is used for the MSCI ACWI and the S&P 500. Yield to Worst is used for the Bloomberg US Agg. Please refer to the Important Disclosures for definitions of the different measures of yield used in this table. For more information related to the Fund’s distribution rate, please see the press release dated May 29, 2025 at: https://fpa.com/insights/?category=fund-announcements. Dividends and other distributions are not guaranteed.

² Source: FPA, as of June 30, 2025. Portfolio composition will change due to ongoing management of the Fund. Cashincludes the non-invested portion of private credit investments. Totals may not add up to 100% due to rounding.

Past performance is no guarantee, nor is it indicative, of future results.

Portfolio Discussion3

Equity

With respect to the recent performance of the Fund, in the previous twelve months, Source’s top five equity performers contributed 3.76% to its return while its bottom five detracted 1.29%.

Trailing Twelve-Month Contributors and Detractors as of June 30, 2025 (%)4

| Top 5 | Performance Contribution | Percent of Portfolio | Bottom 5 | Performance Contribution | Percent of Portfolio |

|---|---|---|---|---|---|

| Holcim/Amrize | 0.97 | 2.4 | Int’l Flavors & Fragrances | -0.44 | 1.8 |

| Citigroup | 0.83 | 2.2 | Glencore | -0.36 | 1.0 |

| Meta Platforms | 0.70 | 1.6 | ICON | -0.17 | 0.3 |

| Safran | 0.67 | 1.3 | NXP Semiconductors | -0.17 | 0.8 |

| Nintendo | 0.59 | 0.8 | Comcast | -0.14 | 2.2 |

| 3.76 | 8.3 | -1.29 | 6.1 |

³ References to individual securities are for informational purposes only, are subject to change, and should not be construed as a recommendation or a solicitation to buy or sell a particular security. Portfolio composition will change due to ongoing management of the Fund. Portfolio holdings for the Fund can be found at fpa.com.

⁴ Reflects the top five contributors and detractors to the Fund’s performance based on contribution to return for the trailing twelve months (“TTM”). Contribution is presented gross of investment management fees, transactions costs, and Fund operating expenses, which if included, would reduce the returns presented. The information provided does not reflect all positions purchased, sold or recommended by FPA during the quarter. A copy of the methodology used and a list of every holding’s contribution to the overall Fund’s performance during the TTM is available by contacting FPA Client Service at [email protected]. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of the securities listed.

We will review two companies that have impacted portfolio performance but that we have not recently discussed.⁵

Holcim/Amrize has performed well on the back of strong business performance and a strategic decision to separate the company’s North American operations. The North American operations have taken the name Amrize and have a US listing (NYSE: AMRZ). We are pleased to see former CEO Jan Jenisch return to lead the North American business.

International Flavors & Fragrances strengthened its balance sheet through a series of asset sales. Since the beginning of 2024, new management has consistently delivered or exceeded financial targets. Despite these positive developments, the company’s shares have re-rated lower, and the stock price has declined.

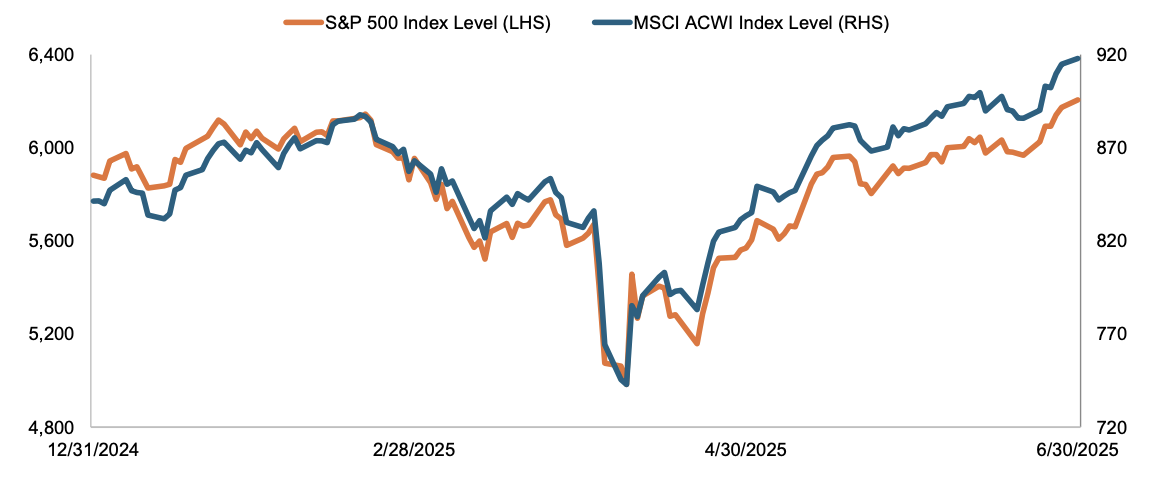

The first half of 2025 brought higher volatility, with the MSCI ACWI and S&P 500 declining by 16.3% and 18.9%, respectively, in a few days in April from their February peaks. For some people, such dramatic movement implies greater risk, but when viewed over a longer horizon, we believe such an opinion becomes harder to defend.

Anchoring to daily pricing fluctuations can cause unnecessary stress and lead to decisions that may reduce investment returns. Instead, internalizing the importance of a longer time frame should help reduce the stress caused by market volatility. We believe we have successfully and consistently applied the discipline of looking to a longer time frame through market swings in our management of the Fund.

⁵ Historical commentaries for the Fund can be accessed here on the fpa.com website. The company data and statistics referenced in this section, including competitor data, are sourced from company press releases, investor presentations, financial disclosures, SEC filings, or company websites, unless otherwise noted.

Past performance is no guarantee, nor is it indicative, of future results.

Daily Pricing in the First Half of 2025 MSCI ACWI & S&P 5006

Semi-Annual Pricing in the First Half of 2025 MSCI ACWI & S&P 5007

⁶ Source: Bloomberg. As of June 30, 2025.

⁷ Source: Bloomberg. As of June 30, 2025.

Past performance is no guarantee, nor is it indicative, of future results.

Life offers little certainty, so we expect uncertainty and build models that reflect a range of potential outcomes: Low, Base, and High. We often have opportunities to acquire good businesses that have bad news and very low expectations for future performance incorporated into their stock prices. To the extent that these businesses exceed these low expectations, we expect to be rewarded. We have operated in this manner for nearly a decade and will continue to do so. Importantly, the world is neither more nor less certain today than it was before Liberation Day. A cogent philosophy, clarity of thought, practiced execution, and repetition should enable us to navigate an ambiguous future, much like the directions you will find on shampoo bottles: “Wash, Rinse, Repeat.”

We continued to trim positions in 2024 and early 2025 in response to elevated valuations, resulting in increased cash as we await opportunities. After President Trump announced his Liberation Day tariffs on Thursday, April 2, 2025, global markets plunged, but just a few trading days later, they significantly rebounded. A stock market drawdown that lasts only a few days is too short a timeframe to materially shift the portfolio. Despite the brevity of the decline, we did selectively redeploy some capital in a few high-conviction positions.

Post Liberation Day Decline and Recovery MSCI ACWI & S&P 5008

| Index | Decline April 2–8 | Recovery April 8–9 | Percent Recovery |

|---|---|---|---|

| MSCI ACWI | -11.1% | 5.7% | 51.4% |

| S&P 500 | -12.1% | 9.5% | 78.5% |

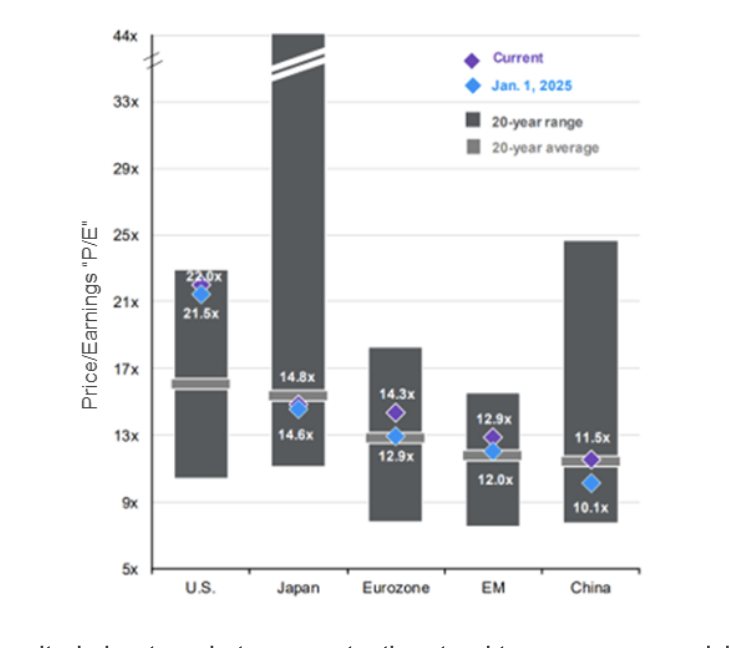

Valuations remain above average, partly justified by lower-than-average interest rates. US companies continue to trade more expensively relative to their historical average and when compared to those based outside the US, which supports our continued interest in investing overseas.

Valuations by Country/Region P/E, next 12 months9

⁸ Source: Bloomberg.

⁹ As of June 30, 2025. Source: J.P. Morgan Asset Management Guide to the Markets. Forward Price to Earnings is a version of the ratio of price-to-earnings (P/E) that uses forecasted earnings for the P/E calculation. The Fund does not include outperformance of any index or benchmark in its investment objectives. Please refer to the Important Disclosures for definitions of key terms and representative indices used for each geographic market shown in the table.

When people become excited about market prospects, they tend to assume more risk, which can manifest in the form of paying a higher multiple, increasing risk exposure, or sometimes using leverage (e.g., through debt or derivatives). We see that happening today. This year is the second-largest inflow year into leveraged equities as of June 10th, and the year isn’t over yet.10 Other speculative indicators help explain today’s rising stock prices. Riskier option volumes have hit new highs (e.g., 0DTE)11. Retail investors have helped lead the charge, ramping up their investments in leveraged equity funds. Retail investors are also buying more stocks on margin (FINRA margin debt has more than doubled in the last five years).12

Broader risk-taking seems less appropriate to us given the current elements of speculative excess combined with relatively high market valuations. The Fund’s equity risk exposure has generally moved in inverse proportion to the market. When stock prices rise, exposure decreases, and conversely, when stock prices decline, exposure increases. This is a generalization, as sectors sometimes exhibit performances and valuations that deviate from the market as a whole. Before the recent market correction, the Fund’s net equity exposure dropped to a recent low of 38.0%. We then purchased equities during the market weakness, which caused net equity exposure to increase moderately to 40.9% at quarter-end.

Source Capital Net Equity Exposure vs MSCI ACWI Q4 2022 vs Q2 202513

¹⁰ Source: DailyShot, BofA Global Investment Strategy, EPFR. 2025 YTD as of June 10, 2025 annualized. Second largest on record.

¹¹ Source: CBOE. As of June 30, 2025. “0DTE” stands for “zero days to expiration.”

¹² Source: MacroMicro. US Margin Debt. As of June 30, 2025. “FINRA” stands for “Financial Industry Regulatory Authority.”

¹³ Source: FPA, Bloomberg. As of June 30, 2025.

Past performance is no guarantee, nor is it indicative, of future results.

As far as closed-end funds go, Source utilizes an unusually wide range of tools and approaches to seek to solve various problems effectively. We endeavor to avoid the cognitive bias of over-reliance on any one method. If it’s raining, for example, we’re looking for our umbrella, not our sunscreen.

Our exposure to different asset classes, regions, industries, market capitalizations, etc. shifts as a function of opportunity. For example, we believe that the intersection of risk and reward is more attractive today in small and medium-sized companies and explains the current attention we have paid to this area. Excessive attention to one area can create opportunities in another, which we believe is the case with small- to midcap (SMID) shares versus large-cap. Large-capitalization stocks, particularly those that are “growthier,” have captured the minds and wallets of investors and now trade at unusually high valuations that do not afford the downside protection we prefer should either growth be less than expected or valuation multiples contract.

Returns & Valuations by Style14

¹⁴ Source: JP Morgan Guide to the Markets 3Q25. As of June 30, 2025. https://am.jpmorgan.com/content/dam/jpm-am-aem/global/en/insights/market-insights/guide-to-the-markets/mi-guide-to-the-markets-us.pdf.

Past performance is no guarantee, nor is it indicative, of future results.

Fixed Income

Traditional

On April 2, the federal government announced significant tariffs on imports into the United States that initially increased the effective tariff rate on U.S. imports to levels not seen since the 1930s. Driven by uncertainty created by a subsequent series of escalating, retaliatory tariffs and associated rhetoric, interest rate volatility increased significantly and credit spreads increased. A 90-day pause on tariffs announced in April drove a subsequent reduction in volatility and decline in spreads.

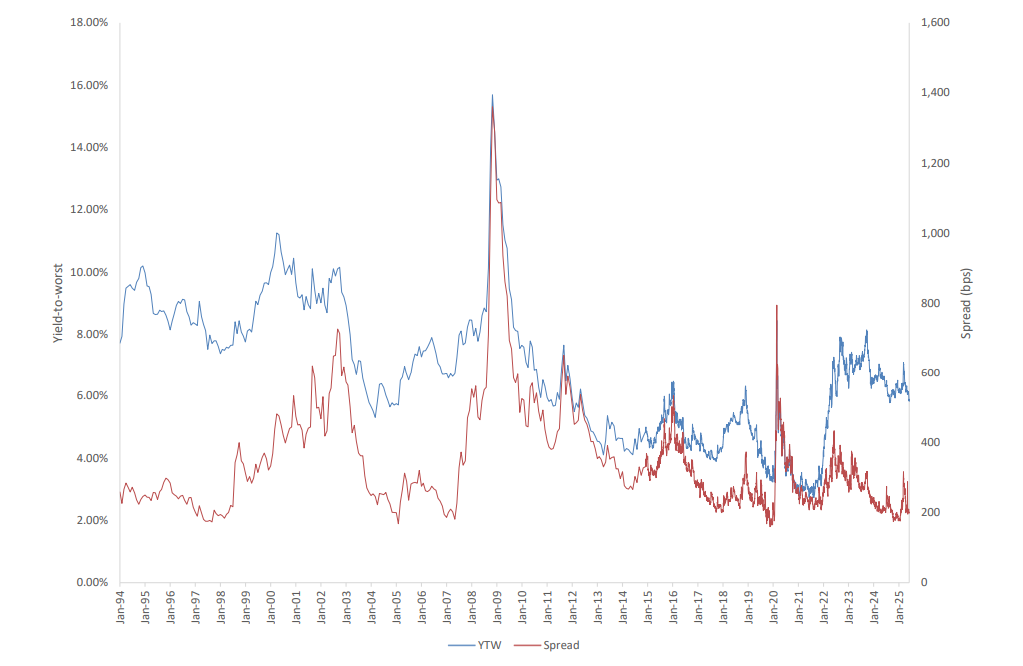

In the week following April 2, spreads on high-yield debt increased significantly before returning to and then declining below pre-tariff levels. The chart below shows the spread on the BB component of the Bloomberg Barclays High Yield Index, excluding energy. We find this measure of the high-yield market to be a better indicator of historical pricing in the high-yield market because it removes some of the distortions associated with changes in the composition of the overall high-yield index. Between April 2 and April 9, spreads on these BB-rated bonds, excluding energy, reached a peak of 317 bps, representing the 69th percentile of the available history. For reference, the spread on the overall high-yield index reached a peak of 476 bps during that time, representing the 48th percentile. At June 30, the spread on the BB index, excluding energy, was 199 bps, and the spread on the overall high yield was 323 bps, both representing the 6th percentile of their respective histories.

Bloomberg US Corporate High-Yield BB ex. Energy Index Yield-To-Worst (YTW) and Spread15

¹⁵ Source: Bloomberg. As of June 30, 2025. YTW is Yield-to-Worst. Spread reflects the quoted spread of a bond that is relative to the security off which it is priced, typically an on-the-run Treasury. Please see Important Disclosures for definitions of key terms.

Past performance is no guarantee, nor is it indicative, of future results.

Judging only by the spread, for a brief moment in early April, the high-yield market looked like it was abnormally cheap, or at least reasonably priced. However, higher uncertainty typically demands a higher expected return, and lower uncertainty typically earns a lower expected return. Returns have become more uncertain due to tariffs. As a result, despite higher potential returns, we did not generally find compelling investments for the Fund during the tariff-induced market turmoil. During that period in early April, we invested in a high-yield bond that we had previously researched. After refreshing our underwriting following the announcement of tariffs, we were able to buy that bond at a price that we believe offered an attractive return for the risk.

Private Credit

Source has 25.1% committed to private credit (including called and uncalled capital) as of quarter-end. We continue to look for opportunities to increase that exposure.

Corporate & Other

Distribution

On May 29, 2025, the Fund’s Board approved maintaining the current rate of 20.83 cents per share for its regular monthly distribution through August 2025.16 This equates to an annualized 5.76% unlevered distribution rate based on the Fund’s closing market price on June 30, 2025.

Discount to NAV

The Fund’s discount to NAV closed at 5.61% at quarter-end. The average discount to NAV for the trailing twelve months was 4.74%.17

Closing

While we cannot guarantee performance results, we assure you that we will continue to move forward with the same philosophy and process, aiming to deliver an attractive rate of return with a focus on downside protection.18

Respectfully submitted,

Source Capital Portfolio Managers

August 14, 2025

¹⁶ For more information related to the Fund’s distribution rate, please see the press release dated May 29, 2025 at: https://fpa.com/news-special-commentaries/fund-announcements. Dividends and other distributions are not guaranteed.

¹⁷ Source: FPA. The average is calculated using daily discount rates.

¹⁸ Downside protection refers strictly to a strategic investment goal and is not meant to imply any guarantee against loss, including the loss of the entire principal amount invested.

The Fund’s investment objective is to seek maximum total return for shareholders from both capital appreciation and investment income to the extent consistent with protection of invested capital.

Past performance is no guarantee, nor is it indicative, of future results.

Important Disclosures

This Commentary is for informational and discussion purposes only and does not constitute, and should not be construed as, an offer or solicitation for the purchase or sale with respect to any securities, products or services discussed, and neither does it provide investment advice. This Commentary does not constitute an investment management agreement or offering circular.

Current performance information is updated monthly and is available by calling 1-800-982-4372 or by visiting fpa.com. Performance data quoted represents past performance, which is no guarantee of future results. Current performance may vary from the performance quoted. The returns shown for Source Capital are calculated at net asset value per share, including reinvestment of all distributions. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions, which would lower these figures. Since Source Capital is a closed-end investment company and its shares are bought and sold on the New York Stock Exchange, your performance may also vary based upon the market price of the common stock.

The Fund is managed according to its investment strategy which may differ significantly in terms of security holdings, industry weightings, and asset allocation from those of the comparative indices. Overall Fund performance, characteristics and volatility may differ from the comparative indices shown.

There is no guarantee the Fund’s investment objectives will be achieved. You should consider the Fund’s investment objectives, risks, and charges and expenses carefully before you invest. You can obtain additional information by visiting the website at fpa.com, by email at [email protected], toll free by calling 1-800-982-4372 or by contacting the Fund in writing.

Effective January 1, 2025, Source Capital, Inc. was reorganized into a Delaware Trust. The Fund’s new name is Source Capital, but it continues to trade on the NYSE under the SOR ticker. There was no change in its investment philosophy, investment strategy, or fundamental investment policies. FPA continues to be the adviser to the Fund. For more information, please refer to the announcement on FPA’s website at https://fpa.com/wp-content/uploads/2025/09/press-release-2024-11.pdf.

The views expressed herein and any forward-looking statements are as of the date of this publication and are those of the portfolio management team. Future events or results may vary significantly from those expressed and are subject to change at any time in response to changing circumstances and industry developments. This information and data has been prepared from sources believed reliable, but the accuracy and completeness of the information cannot be guaranteed and is not a complete summary or statement of available data.

Portfolio composition will change due to ongoing management of the Fund. References to individual financial instruments or sectors are for informational purposes only and should not be construed as recommendations by the Fund or the portfolio managers. It should not be assumed that future investments will be profitable or will equal the performance of the financial instrument or sector examples discussed. The portfolio holdings as of the most recent quarter-end may be obtained at fpa.com.

Investing in closed-end funds involves risk, including loss of principal. Closed-end fund shares may frequently trade at a discount (less than) or premium (more than) to their net asset value. If the Fund’s shares trade at a premium at the most recent value, there is no assurance that any such premium will be sustained for any period of time and will not decrease, or that the shares will not trade at a discount to net asset value thereafter.

Capital markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. It is important to remember that there are risks inherent in any investment and there is no assurance that any investment or asset class will provide positive performance over time.

The Fund may purchase foreign securities, including American Depository Receipts (ADRs) and other depository receipts, which are subject to interest rate, currency exchange rate, economic and political risks; these risks may be heightened when investing in emerging markets. Non-U.S. investing presents additional risks, such as the potential for adverse political, currency, economic, social or regulatory developments in a country, including lack of liquidity, excessive taxation, and differing legal and accounting standards. Non-U.S. securities, including American Depository Receipts (ADRs) and other depository receipts, are also subject to interest rate and currency exchange rate risks.

The return of principal in a fund that invests in fixed income instruments is not guaranteed. The Fund’s investments in fixed income instruments have the same issuer, credit risk, inflation, and credit risks that are associated with underlying fixed income instruments owned by the Fund. Such investments may be secured, partially secured or unsecured and may be unrated, and whether or not rated, may have speculative characteristics. The market price of the Fund’s fixed income investments will change in response to changes in interest rates and other factors.

Generally, when interest rates go up, the value of fixed income instruments, such as bonds, typically go down (and vice versa) and inversely so by varying magnitudes. Credit risk is the risk of loss of principal due to a borrower’s failure to repay a loan. Generally, the lower the quality (or rating) of an instrument, the greater the risk that the issuer will fail to pay interest fully and return principal in a timely manner. If an issuer defaults, the security may lose some or all its value. Lower rated bonds, convertible securities and other types of debt obligations may develop additional risks.

Mortgage-related and asset-backed securities are subject to prepayment risk, can be highly sensitive to changes in interest rates, and are subject to credit risk if default on the underlying assets. Convertible securities are generally of lower investment grade and therefore typically entail greater risk than higher-rated investments. High yield securities can be volatile and subject to high yield market risk and default. The Fund may experience increased costs, losses and delays in liquidating underlying securities should the seller of a repurchase agreement declare bankruptcy or default.

The ratings agencies that provide ratings are Standard and Poor’s (“S&P”), Fitch, Moody’s, Kroll, DBRS, and any other nationally recognized statistical rating organization (“NRSRO”). Credit ratings range from AAA (highest) to D (lowest). Bonds rated BBB or above are considered investment grade (IG). Credit ratings of BB and below are lower-rated securities (junk bonds), high-yielding, non-investment grade bonds (junk bonds) involve higher risks than investment grade bonds. Bonds with credit ratings of CCC or below have high default risk.

Private placement securities are securities that are not registered under the federal securities laws and are generally eligible for sale only to certain eligible investors. While private placements may be liquid, and thus more difficult to sell, because there may be relatively few potential purchasers for such investments, and the sale of such investments may also be restricted under securities laws.

The Fund may use leverage. While the use of leverage may help increase the distribution and return potential of the Fund, it also increases volatility and the risk of loss to the net asset value (NAV), and potentially increases variability of distributions and net asset value. There are costs associated with the use of leverage, including ongoing dividend and/or interest expenses. There also may be expenses for issuing or administering leverage. Leverage changes the Fund’s capital structure through the issuance of preferred shares and/or debt, both of which are senior to the common shares in priority of claims. If short-term interest rates rise, the cost of leverage will also likely rise and will reduce returns earned by the Fund’s common stockholders.

Value investing presents the risk that the holdings or securities may never reach their full market value because the market fails to recognize the portfolio management team considering its true business value or because the portfolio management team has overestimated those values. In addition, value style investing may fall out of favor and underperform growth or other styles of investing during given periods.

Distribution Rate

Distributions may include the net income from dividends and interest earned by fund securities, net capital gains, or in certain cases it may include a return of capital. The Fund may also pay a special distribution at the end of a calendar year to comply with federal tax requirements. All mutual funds, including closed-end funds, periodically distribute profits they earn to investors. By law, if a fund earns net gains from the sale of securities, or dividends and interest from securities, it must pass substantially all of those earnings to its shareholders or it will be subject to corporate income taxes and excise taxes. These taxes would, in effect, reduce investors’ total return. First Pacific Advisors, LP does not provide legal, accounting, or tax advice.

The Fund’s distribution rate may be affected by numerous factors, including changes in realized and unrealized market returns, Fund performance, and other factors. There can be no assurance that a change in market conditions or other factors will not result in a change in the Fund’s distribution rate at a future time.

Index Definitions

Comparison to any index is for illustrative purposes only and should not be relied upon as a fully accurate measure of comparison. The Fund may be less diversified than the indices noted herein and may hold non-fund securities or securities that are not comparable to those contained in an index. Indices will hold positions that are not within the Fund’s investment strategy. Indices are unmanaged and do not reflect any commissions, transaction costs, or fees and expenses which would be incurred by an investor purchasing the underlying securities and which would reduce the performance in an actual account. You cannot invest directly in an index. The Fund does not include outperformance of any index in its investment objectives.

S&P 500 Index includes a representative sample of 500 hundred companies in leading industries of the U.S. economy. The Index focuses on the large-cap segment of the market, with over 80% coverage of U.S. equities, but is also considered a proxy for the total market.

MSCI ACWI NR USD Index (MSCI ACWI) is an unmanaged free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. Net Return (NR) indicates that withholding taxes are applied to dividend reinvestments. MSCI uses withholding tax rates applicable to Luxembourg holding companies.

Bloomberg U.S. Aggregate Bond Index provides a measure of the performance of the US investment grade bonds market, which includes investment grade US Government bonds, investment grade corporate bonds, mortgage pass-through securities and asset-backed securities that are publicly offered for sale in the United States. The securities in the Index must have at least 1-year remaining in maturity. In addition, the securities must be denominated in US dollars and must be fixed rate, nonconvertible, and taxable.

Consumer Price Index (CPI) is an unmanaged index representing the rate of inflation of U.S. consumer prices as determined by the U.S. Department of Labor Statistics. The CPI is presented to illustrate the Fund’s purchasing power against changes in the prices of goods as opposed to a benchmark, which is used to compare the Fund’s performance. There can be no guarantee that the CPI will reflect the exact level of inflation at any given time.

60% S&P500 / 40% BBG U.S. Aggregate Bond Index is a hypothetical combination of unmanaged indices and comprises 60% S&P 500 Index and 40% Bloomberg U.S. Aggregate Bond Index.

60% MSCI ACWI / 40% BBG U.S. Aggregate Bond Index is a hypothetical combination of unmanaged indices and comprises 60% MSCI ACWI Index and 40% Bloomberg U.S. Aggregate Bond Index.

Bloomberg U.S. High Yield Index measures the market of USD-denominated, non-investment grade, fixed-rate, taxable corporate bonds.

Bloomberg U.S. High Yield BB ex Energy Index measures the market of USD-denominated, non-investment grade, fixed-rate, taxable BB-rated corporate bonds excluding energy sector.

Glossary of Terms

Discount to Net Asset Value (NAV) is a pricing situation when a closed-end fund’s market trading price is lower than its daily net asset value (NAV).

Dividend Yield is the dividend per share divided by the price per share.

Effective Yield is the total yield on an investment, converted to its nominal yield—which is the stated interest rate of the bond’s coupon.

High Yield (HY) bond is a high paying bond with a lower credit rating (S&P and Fitch, BB+ and lower; Moody’s, Ba1 or lower) than investment-grade corporate bonds, Treasury bonds and municipal bonds. Because of the higher risk of default, these bonds pay a relatively higher yield than investment grade bonds.

Investment Grade (IG) is a rating (S&P and Fitch, BBB– and higher; Moody’s Baa3 and higher) that indicates that a bond has a relatively low risk of default.

Market Capitalization refers to the total dollar market value of a company’s outstanding shares of stock.

Net Asset Value (NAV) represents the net value of a mutual fund and is calculated as the total value of the fund’s assets minus the total value of its liabilities and is shown as a per share price.

Standard Deviation is a measure of the dispersion or spread of data from its mean.

Volatility is a statistical measure of the dispersion of returns for a given security or market index. In most cases, the higher the volatility, the riskier the security. Volatility is often measured as either the standard deviation or variance between returns from that same security or market index.

Spread reflects the quoted spread of a bond that is relative to the security off which it is priced, typically an on-the-run treasury.

Yield is the discount rate that links the bond’s cash flows to its current dollar price

Yield to Worst (YTW) is a measure of the lowest possible yield that can be received on a bond that fully operates within the terms of its contract without defaulting. It is a type of yield that is referenced when a bond has provisions that would allow the issuer to close it before it matures.

©2025 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted by Morningstar to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee, nor is it indicative, of future results.