You should consider the Fund’s invehttps://fpa.com/wp-content/uploads/FPA-Queens-Road-Value-Fund-Commentary-2025-09.pdfstment objectives, risks, and charges and expenses carefully before you invest. The Prospectus details the Fund’s objective and policies and other matters of interest to a prospective investor. Please read the Prospectus carefully before investing. The Prospectus may be obtained by visiting the website at fpa.com, by calling toll-free, 1-800-982-4372, or by contacting the Fund in writing.

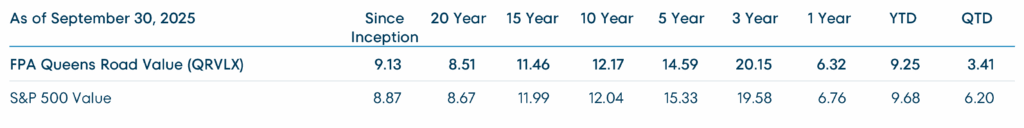

Average Annual Total Returns (%)

Index data source: Morningstar.

Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. This data represents past performance and investors should understand that investment returns and principal values fluctuate, so that when you redeem your investment it may be worth more or less than its original cost. Current month-end performance data, which may be lower or higher than the performance data quoted, may be obtained at fpa.com or by calling toll-free, 1-800-982-4372.

The FPA Queens Road Value Fund (“Fund”) commenced operations on June 13, 2002. Periods greater than one year are annualized. Fund performance is shown net of all fees and expenses and includes reinvestment of all distributions. Fund performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares, which would lower these figures. An investor cannot invest directly in an index.

Prior to November 1, 2020, the performance shown reflects the historical performance of the Fund when Bragg Financial Advisors, Inc. (“BFA”) served as investment adviser of the Fund.

From inception of the Fund to December 31, 2004, BFA and its affiliates voluntarily absorbed certain expenses of the Fund and voluntarily waived its management fee. Had BFA not done this, returns would have been lower during that period. Effective January 1, 2005 through October 31, 2020, BFA had a unitized fee structure that limited operating expenses to 0.95%.

The Fund’s Total Annual Operating Expenses (as of the most recent prospectus) before reimbursement are 1.36%. The adviser has contractually agreed to waive management fees and reimburse the Fund for operating expenses in excess of 0.73% of average daily net assets of the Fund, excluding interest, taxes, brokerage fees and commissions payable by the Fund in connection with the purchase or sale of portfolio securities, fees and expenses of other funds in which the Fund invests, and extraordinary expenses, including litigation expenses not incurred in the Fund’s ordinary course of business, until September 30, 2026. These fee waivers and expense reimbursements are subject to possible recoupment by the adviser from the Fund in future years (within the three years from the date when the amount is waived or reimbursed) if such recoupment can be achieved within the lesser of the foregoing expense limits or the then-current expense limits. Similarly, the adviser is permitted to seek reimbursement from the Fund, subject to certain limitations, of fees waived or payments made by adviser to the Predecessor Fund (defined below) prior to the Predecessor Fund’s reorganization on July 28, 2023, for a period ending three years after the date of the waiver or payment. This agreement may be terminated only by the Fund’s Board of Trustees, upon written notice to the adviser.

Please see important disclosures at the end of the commentary.

Dear Fellow Shareholders

FPA Queens Road Value Fund (“Fund”) returned 3.41% for the third quarter of 2025. This compares to the S&P 500 Value Index (“Index”) return of 6.20% for the same period. Year to date, the Fund returned 9.25% while the Index returned 9.68%.

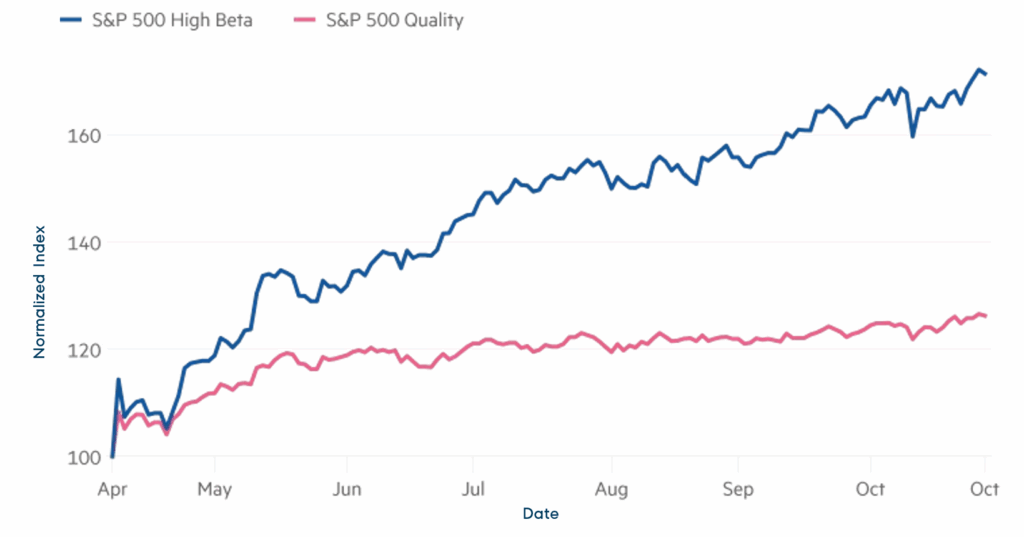

On October 29, Robert Armstrong in the Financial Times published an essay on the “junk rally” in stocks since Liberation Day on April 2. Higher beta stocks have dramatically outperformed this year, leaving quality in the dust. According to Jacob Pozharny of Bridgeway Capital, this is in striking contrast to the terrible sentiment among business leaders as expressed in filings and on conference calls.1

The Mercy of Quality is Strained: Indices rebased2

In the same article, Armstrong references Goldman Sachs data provided by Liz Ann Sonders, the chief investment strategist at Charles Schwab, who sees a similar bifurcation in thematic baskets of stocks. The best performers are “Quantum computing, drones, profitless tech, heavily shorted stocks, memes, retail, the heavily indebted. It’s a rush for anything trendy, speculative, risky or low quality.”1 Meanwhile, everything safe and defensive has dramatically underperformed.

1 Robert Armstrong, “It’s a junk rally” published in the Financial Times on October 29, 2025. https://www.ft.com/content/67fbf464-497b-4a79-9d45-fc64046f6c7d

2 Source: LSEG via markets.ft.com

Goldman Sachs (GS) Equity Basket Performance as reported by Robert Armstrong in the FT 3

The table shows the actual performance of different thematic baskets of stocks (constructed by Goldman Sachs using proprietary methods) from the 2025 Liberation Day low (4/8/25) through the reporting date (10/15/25).

Since the index low following Liberation Day, trendy and speculative stocks have dramatically outperformed safe and defensive stocks, according to Robert Armstrong in the FT.3

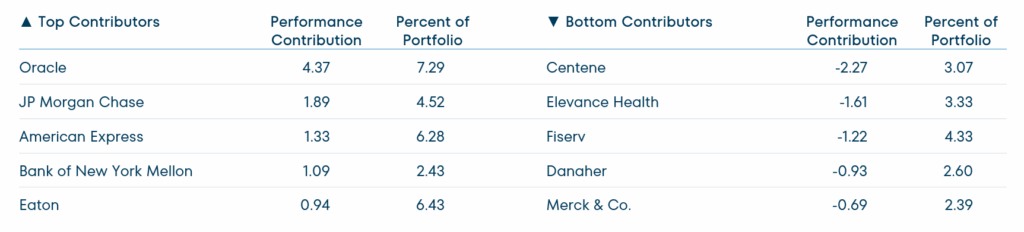

Trailing Twelve Months (TTM) Top & Bottom Contributors (%)4

Our top performers on a twelve month basis include Oracle, which is benefitting from continued spending on cloud infrastructure and Eaton, which manufactures electrical components including for data centers. Three well run financials – American Express, JPMorgan Chase and Bank of New York Mellon, have also performed well.

Our bottom five performers include two managed care providers, Elevance and Centene, and Merck, a pharmaceutical manufacturer. Danaher makes instruments, consumables and diagnostics for the biotech and healthcare industries and has been suffering from a slowdown in those markets. And Fiserv, a payments and financial infrastructure company, has struggled with slowing earnings growth and competitive pressure.

At its most basic, our process compares a company’s current price to what we expect the business to look like three to five years out. Our four pillars – balance sheet strength, valuation, management, and industry analysis – provide guidance and guardrails. Taking a long-term view has served us well in the past and we are confident that our disciplined and patient approach will continue to be rewarded over the long-term.

In our experience, when there is exuberance in the markets, it is usually overdone. But when markets get volatile and the pundits predict doom and gloom, it is usually overdone as well. We acknowledge the heightened uncertainty as well as the headwinds the economy faces. But given the current valuations and long-term fundamentals of the Fund’s holdings, we feel positive about the portfolio and remain significant co-investors with you.

Respectfully,

Steve Scruggs, CFA

Portfolio Manager

September 30, 2025

3 External data used for discussion purposes only. Not representative of Fund holdings or portfolio. FPA Queens Road Value Fund does not determine Goldman Sachs thematic baskets. Source: Robert Armstrong, “It’s a junk rally” published in the Financial Times on October 29, 2025. https://www.ft.com/content/67fbf464-497b-4a79-9d45-fc64046f6c7d

4 Reflects the top contributors and top detractors to the Fund’s performance based on preliminary contribution to return for the trailing twelve months (TTM) period ending September 30, 2025. Contribution is presented gross of investment management fees, transactions costs, and Fund operating expenses, which if included, would reduce the returns presented. Portfolio weights represent the average weights over the periods noted. A copy of the methodology used and a list of every holding’s contribution to the overall Fund’s performance during the quarter to date (QTD) and year to date (YTD) is available by contacting [email protected]. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of the securities listed. Totals may not sum due to rounding. Note: September, 30, 2025 company descriptions were developed by the investment team and unless otherwise noted reflect the most recent data made available by the companies or third-party research firms the investment team believe to be reliable.

Important Information

This Commentary is for informational and discussion purposes only and does not constitute, and should not be construed as, an offer or solicitation for the purchase or sale of any securities, products or services discussed, and neither does it provide investment advice. Any such offer or solicitation shall only be made pursuant to the Fund’s Prospectus, which supersedes the information contained herein in its entirety. This Commentary does not constitute an investment management agreement or offering circular.

The statements contained herein reflect the opinions and views of the portfolio manager as of the date written, is subject to change without notice, and may be forward-looking and/or based on current expectations, projections, and/or information currently available. Such information may not be accurate over the long-term. These views may differ from other portfolio managers and analysts of the firm as a whole and are not intended to be a forecast of future events, a guarantee of future results or investment advice.

Portfolio composition will change due to ongoing management of the Fund. References to individual securities or sectors are for informational purposes only and should not be construed as recommendations by the Fund, the portfolio manager, the Adviser, the Sub-Adviser or the distributor. It should not be assumed that future investments will be profitable or will equal the performance of the security or sector examples discussed. The portfolio holdings as of the most recent quarter-end may be obtained at fpa.com.

Future events or results may vary significantly from those expressed and are subject to change at any time in response to changing circumstances and industry developments. The information and data contained herein has been prepared from sources believed reliable, but the accuracy and completeness of the information cannot be guaranteed and is not a complete summary or statement of all available data.

The information contained herein is not complete, may change, and is subject to, and is qualified in its entirety by, the more complete disclosures, risk factors, and other information contained in the Fund’s Prospectus and Statement of Additional Information. The information is furnished as of the date shown. No representation is made with respect to its completeness or timeliness. The information is not intended to be, nor shall it be construed as, investment advice or a recommendation of any kind.

Certain statements contained in this presentation may be forward-looking and/or based on current expectations, projections, and information currently available. Actual events or results may differ from materially those we anticipate, or the actual performance of any investments described herein may differ from those reflected or contemplated in such forward-looking statements, due to various risks and uncertainties. We cannot assure future results and disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events, or otherwise. Such statements may or may not be accurate over the long term. Statistical data or references thereto were taken from sources which we deem to be reliable, but their accuracy cannot be guaranteed.

The reader is advised that the Fund’s investment strategy includes active management with corresponding changes in allocations from one period of time to the next. Therefore, any data with respect to investment allocations as of a given date is of limited use and may not be reflective of the portfolio manager’s more general views with respect to proper geographic, instrument and /or sector allocations. The data is presented for indicative purposes only and, as a result, may not be relied upon for any purposes whatsoever.

In making any investment decision, you must rely on your own examination of the Fund, including the risks involved in an investment. Investments mentioned herein may not be suitable for all recipients and in each case, potential investors are advised not to make any investment decision unless they have taken independent advice from an appropriately authorized advisor. An investment in any security mentioned herein does not guarantee a positive return as securities are subject to market risks, including the potential loss of principal. You should not construe the contents of this document as legal, tax, investment or other advice or recommendations.

Fund performance presented is calculated on a total return basis, which includes the reinvestment of all income, plus realized and unrealized gains/losses, if applicable. Unless otherwise indicated, performance results are presented on a net of fees basis and reflect the deduction of, among other things: management fees, brokerage commissions, operating and administrative expenses, and accrued performance fee/allocation, if applicable.

The information provided in this presentation is based upon data existing as of the date(s) of the report and has not been audited or reviewed. While we believe the information to be accurate, it is subject in all respects to adjustments that may be made after proper review and reconciliation.

Investments carry risks and investors may lose principal value. Capital markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Small and mid-cap stocks involve greater risks and they can fluctuate in price more than larger company stocks. You risk paying more for a security than you received from its sale. Groups of stocks, such as value and growth, go in and out of favor which may cause certain funds to underperform other equity funds. The value of an individual security can be more volatile than the market as a whole and can perform differently than the value of the market as a whole.

The prices of securities held by the Fund may decline in response to certain events taking place around the world, including those directly involving the companies whose securities are owned by the Fund. Securities in the Fund’s portfolio may underperform due to inflation (or expectations for inflation), interest rates, global demand for particular products or resources, natural disasters, pandemics, epidemics, terrorism, regulatory events and governmental or quasi-governmental actions. There is a risk that you may lose money by investing in the Fund.

Value style investing presents the risk that the holdings or securities may never reach their full market value because the market fails to recognize what the portfolio management team considers the true business value or because the portfolio management team has misjudged those values. In addition, value style investing may fall out of favor and underperform growth or other styles of investing during given periods.

Please refer to the Fund’s Prospectus for a complete overview of the primary risks associated with the Fund.

©2025 Morningstar, Inc. All Rights Reserved. The Morningstar information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted by Morningstar to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

The FPA Funds are distributed by Distribution Services, LLC. 190 Middle Street, Suite 301, Portland, ME 04101. Distribution Services, LLC and FPA are not affiliated.

Index Definitions

The Fund will typically be less diversified than the indices noted herein and may hold non-index securities or securities that are not comparable to those contained in an index. Indices will hold positions that are not within the Fund’s investment strategy. Indices are unmanaged and do not reflect any commissions, transaction costs, or fees and expenses which would be incurred by an investor purchasing the underlying securities and which would reduce the performance in an actual account. You cannot invest directly in an index

Standard & Poor’s 500 Stock Index (S&P 500) is a capitalization-weighted index which covers industrial, utility, transportation and financial service companies, and represents approximately 75% of the New York Stock Exchange (NYSE) capitalization and 30% of NYSE issues. The S&P 500 is considered a measure of large capitalization stock performance.

The S&P 500 High Beta Index measures the performance of 100 constituents in the S&P 500 that are most sensitive to changes in market returns. The index is designed for investors initiating a bullish strategy or making a directional bet on current markets.

The S&P 500 Value Index is a subset of the S&P 500 index. Companies within the index are ranked based on growth and value factors including three-year change in earnings price/share, three-year sales/share growth rate, momentum, book value/price ratio, earnings/price ratio, sales/price ratio. The companies at the bottom of this list, that have a higher Value Rank, comprising 33% of the total index market capitalization are designated as the Value basket.

The S&P 500 Quality Index is designed to track high quality stocks in the S&P 500 by quality score, which is calculated based on return on equity, accruals ratio and financial leverage ratio.