40 Years of Class-Leading1 Risk-Adjusted Returns

On July 11, 2024, FPA New Income Fund (the “Fund”) celebrated its 40th anniversary under FPA’s management. Very few funds survive, let alone thrive, for 40 years. Of Morningstar’s 286 short-term and intermediate core bond funds,2 only 12 have survived as long as FPA New Income and, of those funds, FPA New Income has generated the best risk-adjusted returns over 40 years!

40 Year Risk-Adjusted Returns and Annualized Return

| Fund | Sharpe Ratio | Sortino Ratio | Annualized Return |

|---|---|---|---|

| FPA New Income – Institutional | 0.92 | 1.60 | 6.20 |

| Vanguard Short-Term Investment-Grade Fund | 0.74 | 1.14 | 5.32 |

| Fidelity Advisor Limited Term Bond Fund | 0.64 | 1.01 | 5.8 |

| Russell Inv Short Duration Bond Fund | 0.61 | 0.96 | 4.77 |

| Fidelity Intermediate Bond Fund | 0.61 | 0.96 | 5.78 |

| Principal Core Fixed Income Fund | 0.60 | 0.94 | 6.26 |

| Fidelity Investment Grade Bond Fund | 0.58 | 0.87 | 6.11 |

| American Funds Bond Fund of America Fund | 0.56 | 0.84 | 6.09 |

| T. Rowe Price Short-Term Bond Fund | 0.53 | 0.8 | 4.48 |

| Nationwide Loomis Core Bond Fund | 0.52 | 0.82 | 6.07 |

| Nationwide Bond Institutional Fund | 0.5 | 0.75 | 5.94 |

| T. Rowe Price New Income Fund | 0.5 | 0.72 | 5.58 |

| Bloomberg U.S. Agg Bond Index | 0.63 | 0.99 | 6.29 |

For illustrative purposes only. Past results are no guarantee of future results and current performance may be higher or lower than the performance shown. This data represents past performance and investors should understand that investment returns and principal values fluctuate, so that when you redeem your investment it may be worth more or less than its original cost. Current month-end performance data, which may be lower or higher than the performance data quoted, may be obtained by calling toll-free, 1-800-982- 4372. Source: Morningstar Direct. FPA New Income Fund inception was July 11, 1984. Data shown for Sharpe Ratio and Sortino Ratio is from August 1, 1984 to June 30, 2024. Data shown for Annualized Return is from July 12, 1984 to July 11, 2024. Risk-adjusted returns shown starting with first full month of performance. Data shown for the 12 funds in the Morningstar Short-Term Bond and Intermediate Term Bond categories that were in existence since July 1984. Sharpe Ratio measures risk-adjusted performance. The Sharpe ratio is calculated by subtracting the risk-free rate – such as that of the 10-year U.S. Treasury bond – from the rate of return for a portfolio and dividing the result by the standard deviation of the portfolio returns. Sortino Ratio is a variation of the Sharpe Ratio, that measures the risk-adjusted return on an investment. It is calculated by subtracting the risk-free rate from the average return of an investment portfolio over a period of time, and dividing the result by the standard deviation of the portfolio’s negative returns during that period. In relation to the Annualized Return: Periods greater than one year are annualized. Performance is net of all fees and expenses and includes the reinvestment of distributions. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares, which would lower these figures. Please see page 6 for the average annual returns of the above funds and end of this document for Important Disclosures related to these funds, including standard performance, and definitions of key terms.

1 “Class-leading” is defined in comparison to the 11 Morningstar Short-Term Bonds and Intermediate Core Bonds, excluding FPA New Income, with at least 40 years of history as listed in the table titled “Risk-Adjusted Returns and Annualized Return Comparison” (referred to herein as “Comparable Funds”) and the Bloomberg U.S. Aggregate Bond Index.

2 Total number of funds in the Morningstar Short-term Bond and Intermediate Core Bond categories is as of May 31, 2024 and only includes the oldest share class for each fund in those categories.

Past performance is no guarantee, nor is it indicative, of future results.

The Fund’s class-leading risk-adjusted returns are consistent with the goal described in 2009 by founding portfolio manager, Bob Rodriguez: “Our goal has been one of creating a fund that would compare favorably to the benchmark indexes while having materially less volatility risk. In other words, we wanted our shareholders to have the luxury and benefit of being able to sleep at night with their investment in FPA New Income.”3

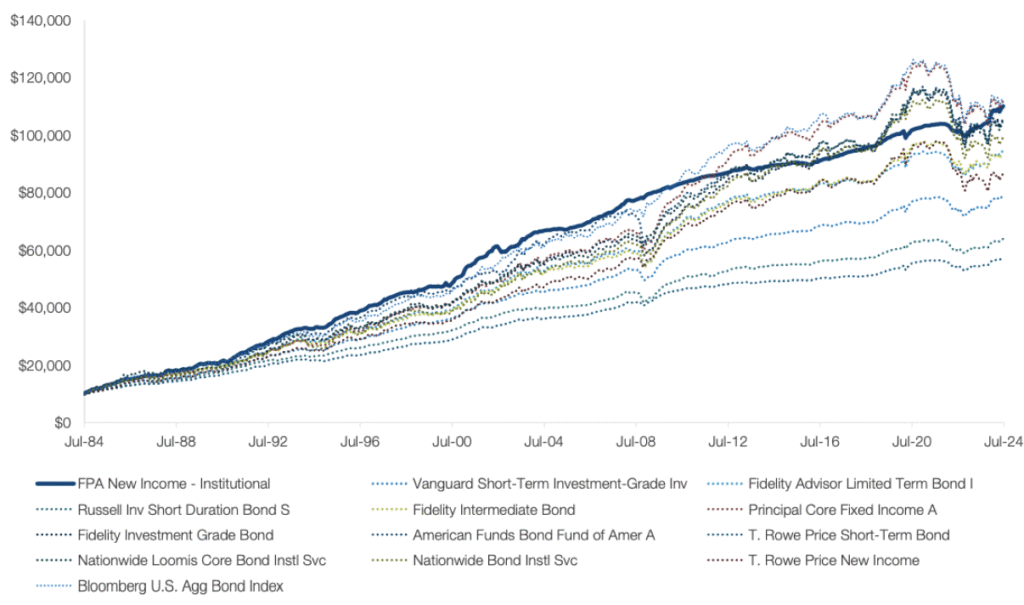

We believe the Fund’s risk-adjusted return statistics are impressive but the data does not fully convey the performance over this period. To better describe the experience of a 40-year investment in the Fund, the chart below shows the growth in value of an investment in the Fund compared with the other funds and index listed above:

“Our goal has been one of creating a fund that would compare favorably to the benchmark indexes while having materially less volatility risk. In other words, we wanted our shareholders to have the luxury and benefit of being able to sleep at night with their investment in FPA New Income.”

3 FPA New Income Fund Letter to Shareholders – 11/25/2009

https://www.sec.gov/Archives/edgar/data/99203/000110465909067043/a09-29504_2ncsr.htm Note, comparison to an index is for illustrative purposes only. The Fund does not include outperformance of any index in its investment objectives.

FPA New Income Fund Growth of $10,000 vs Comparable Funds and the Bloomberg U.S. Aggregate Bond Index from July 1984 to June 2024

Source: Morningstar. Data shown for the period July 31, 1984 through June 30, 2024. The chart illustrates the performance of a hypothetical $10,000 investment made in the funds noted since inception of FPA New Income on July 11, 1984. Fund returns shown assume reinvestment of distributions and do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares, which would lower these figures. This chart is not intended to imply any future performance of the Fund or of any other fund noted.

Past performance is no guarantee of future results. Please see the end of this document for Important Disclosures related to this fund.

3 FPA New Income Fund Letter to Shareholders – 11/25/2009. https://www.sec.gov/Archives/edgar/data/99203/000110465909067043/a09-29504_2ncsr.htm; Note, comparison to an index is for illustrative purposes only. The Fund does not include outperformance of any index in its investment objectives.

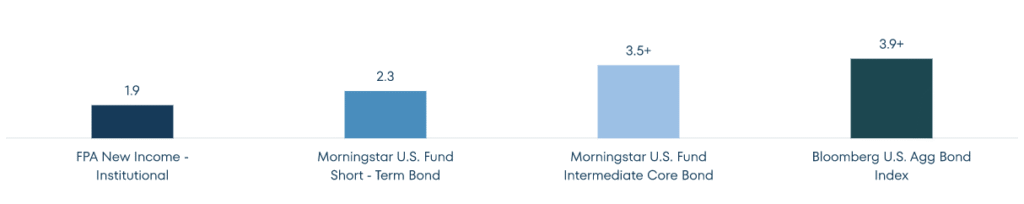

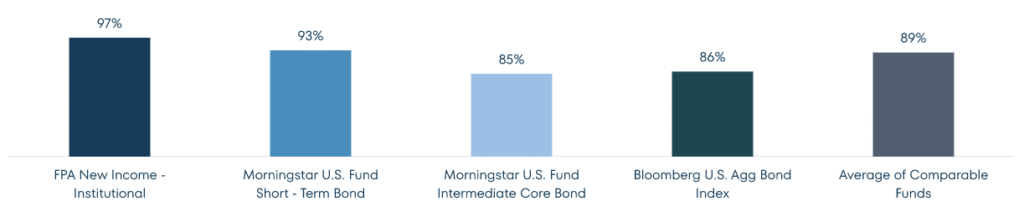

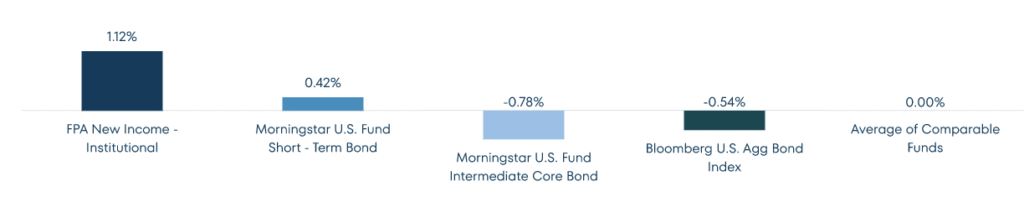

Not only has the Fund delivered better or comparable total returns over 40 years, but that performance has come with fewer and less severe drawdowns along the way and, particularly recently, with upside participation. Because of these lower volatility returns, we believe the Fund has been relatively easy to own. As shown below, doing a much better job of protecting capital during periods of turmoil over the past 40 years left the Fund well-placed to take advantage of attractively-priced investment opportunities created by the turmoil. The combination of better capital preservation and opportunistic investing has led to faster recoveries from drawdowns – including the drawdown induced by rising interest rates in 2022 – and better returns.

Maximum Time to High-Water Mark (in Years) since 19844

Note: A high-water mark is the highest peak in value that the Fund, category, or index has reached. The plus sign represents a high-water mark that has not yet been reached.

Percentage of Historical 12-Month Rolling Periods with Positive Performance5

Worst Return During a 5-Year Period6

4 Source: Morningstar Direct. The chart illustrates the high-water mark for the FPA New Income – Institutional from August 1, 1984 through June 30, 2024 compared to the Morningstar U.S. Fund Short-Term Bond, Morningstar U.S. Fund Intermediate Core Bond, and Bloomberg U.S. Agg Bond Index.

5 Source: Morningstar Direct. The chart illustrates the percent of 12-month rolling periods that resulted in positive average performance for the FPA New Income Fund – Institutional from August 1, 1984 through June 30, 2024 compared to the Morningstar U.S. Fund Short-Term Bond, Morningstar U.S. Fund Intermediate Core Bond, Bloomberg U.S. Agg Bond Index, and the average returns of the 11 Morningstar Short-Term and Intermediate Core Bonds with at least 40 years of history (i.e., “Comparable Funds”).

6 Source: Morningstar Direct. The chart illustrates the worst five-year rolling average returns for the FPA New Income Fund – Institutional from August 1, 1984 through June 30, 2024 compared to the Morningstar U.S. Fund Short-Term Bond, Morningstar U.S. Fund Intermediate Core Bond, the Bloomberg U.S. Agg Bond Index, and the average of the Comparable Funds.

The best summary of the investment approach that led to the results above and has always guided us was written 30 years ago. In 1994, Bob Rodriguez wrote a Letter to Shareholders to mark the 10-year anniversary of FPA New Income, which is just as relevant today with respect to the Fund’s performance over the past four decades.7 Bob reflected that the keys to the Fund’s attractive returns and capital preservation were a focus on long-term total return and flexibility. Bob highlighted the importance of managing for total return (i.e., yield and potential price appreciation) rather than just yield, and the value of sacrificing yield in the short-run to achieve a better total return in the long-run. Bob then went on to describe the value of flexibility saying, “Your Fund has also been one of the few with the flexibility to invest in a broad cross section of credit quality categories. Most funds are sector-oriented and, thus, are forced to invest in only narrow segments of the bond market. Should a particular sector come under stress, funds within that sector have few options. Your Fund has had the ability to take advantage of opportunities provided by such stress when they have developed. This reflects our contrarian investment instincts. When most are selling, we typically consider buying and vice versa.” Combining the long-term total return focus with flexibility, Bob summarized the Fund’s investment approach by saying “Our success has emanated from the basic strategy of winning by not losing.”

The past 40 years have brought many challenges (and, in some cases, opportunities), including multiple distressed debt cycles, a Global Financial Crisis, novel monetary policy, a pandemic, multiple market bubbles, and the end of a multi-decade bull market in bonds, among other things. Through it all, we have achieved better risk-adjusted returns because we have been guided at all times by the investment philosophy that Bob articulated above and established in 1984: winning by not losing.

The bedrock of “winning by not losing” is disciplined, long-term oriented absolute value investing. Bob described this investment style in 2004, writing “…we focus on both the return on capital as well as the return of capital. At various times over an interestrate cycle, one has to shift priority between these two. We find that most of the time the discussion revolves around return on capital. Most fund managers are loath to have their bond portfolios structured in a way that would be too different from their benchmark index for fear of being accused of the mortal sins of ‘tracking error’ and quarterly underperformance. We spend zero time worrying about either of these.”8 Bob elaborated further in 2006: “…we are extremely disciplined in our investment approach. We choose to focus on the long term rather than on shorter-term periods. Many investment professionals do not, since short-term underperformance may threaten their jobs or the firm may lose assets under management. We believe that, if we keep our attention on the long-term goal, i.e., total return with a minimum of principal risk, the asset losses that may occur will be recovered when it is demonstrated that our discipline has been the correct strategy. At First Pacific Advisors, we fundamentally believe that to achieve superior long-term relative performance, one must accept periods of underperformance, no matter how difficult it may be.”9

7 The Letter to Shareholders was contained in the Fund’s Semi-Annual Report for the 6-month period ending March 31, 1994. A copy of the letter is available upon request.

8 FPA New Income Fund Letter to Shareholders – 12/07/2004. https://www.sec.gov/Archives/edgar/data/99203/000104746904036302/a2145672zn-csr.txt

9 FPA New Income Fund Letter to Shareholders – 6/8/2006. https://www.sec.gov/Archives/edgar/data/99203/000110465906040482/a06-8311_2ncsrs.htm

The investment principles established by Bob 40 years ago were followed ably by his successor, Thomas Atteberry, and continue to guide the team that manages the Fund today. We view investing as a marathon, not a sprint. As has been true in the past, we expect periods in the future where the Fund’s returns lag other investment alternatives in the short-term – but 40 years have shown us that patience and discipline can lead us to attractive results over time.

Essential to maintaining this discipline is that we have managed the Fund’s capital as if it were our own, because it is; your portfolio managers have always had a significant personal investment in the Fund alongside you – our partners and fellow shareholders. We also put our fellow investors first. We proactively soft-closed the Fund for nearly two years from 2020 to 2022 because we determined that accepting new investors would not be in the best interests of our existing investors. Your Fund is one of the only fixed income funds to ever close to new investors, because our goal is to be in the returns hall of fame, not the assets under management hall of fame.

In closing, we thank our fellow investors for their confidence and conviction over the past 40 years. An investment strategy can only find success if there is alignment between its objectives and its investors, and we have been fortunate to find that alignment with you.

Sincerely,

Abhi Patwardhan

Important Disclosures

Fund Objectives and Returns

The below provides information about the twelve funds referenced on page 1 for comparative purposes.

FPA New Income – Institutional: The investment seeks to provide long-term total return, which includes income and capital appreciation, while considering capital preservation. The fund primarily invests in a diversified portfolio of debt securities, cash and cash equivalents. It generally invests in highly rated debt securities and invests at least 75% of its total assets, calculated at market value at the time of purchase, in debt securities rated at least A- or its equivalent by a NRSRO and in cash equivalent securities. Performance as of 6/30/2024: 1 year: 7.09%; 3 years: 2.04%; 5 years: 2.12%; 10 years: 2.09%. As of most recent prospectus, total expense ratio is 0.59%, and net expense ratio is 0.45%.

American Funds Bond Fund of Amer A: The investment seeks to provide as high a level of current income as is consistent with the preservation of capital. The fund invests at least 80% of its assets in bonds and other debt securities, which may be represented by derivatives. It invests at least 60% of its assets in debt securities rated A3 or better or A- or better by Nationally Recognized Statistical Ratings Organizations designated by the fund’s investment adviser, or in debt securities that are unrated but determined to be of equivalent quality by the fund’s investment adviser, and in U.S. government securities, money market instruments, cash or cash equivalents. Performance as of 6/30/2024: 1 year: 2.61%; 3 years: -3.05%; 5 years: 0.29%; 10 years: 1.46%. As of most recent prospectus, total expense ratio is 0.62%, and net expense ratio is 0.62%.

Fidelity Advisor Limited Term Bond I: The investment seeks to provide a high rate of income. The fund normally invests at least 80% of assets in debt securities of all types and repurchase agreements for those securities. Allocating the fund’s assets across investment-grade, high yield, and emerging markets debt securities. Using the Fidelity Limited Term Composite Index℠ as a guide in allocating assets across the investment-grade and high yield asset classes. Performance as of 6/30/2024: 1 year: 6.16%; 3 years: 0.32%; 5 years: 1.42%; 10 years: 1.70%. As of most recent prospectus, total expense ratio is 0.35%, and net expense ratio is 0.30%.

Fidelity Intermediate Bond: The investment seeks a high level of current income. Normally investing at least 80% of assets in investment-grade debt securities of all types and repurchase agreements for those securities. Managing the fund to have similar overall interest rate risk to the Bloomberg U.S. Intermediate Government/Credit Bond Index. Normally maintaining a dollar-weighted average maturity between three and 10 years. Allocating assets across different market sectors and maturities. Investing in domestic and foreign issuers. Performance as of 6/30/2024: 1 year: 4.50%; 3 years: -1.20%; 5 years: 0.88%; 10 years: 1.65%. As of most recent prospectus, total expense ratio is 0.45%, and net expense ratio is 0.45%.

Fidelity Investment Grade Bond: The investment seeks a high level of current income. The fund normally invests at least 80% of assets in investment-grade debt securities (those of medium and high quality) of all types and repurchase agreements for those securities. It allocates assets across different market sectors and maturities. The fund invests in domestic and foreign issuers. Performance as of 6/30/2024: 1 year: 3.26%; 3 years: -2.70%; 5 years: 0.54%; 10 years: 1.81%. As of most recent prospectus, total expense ratio is 0.45%, and net expense ratio is 0.45%.

Nationwide Bond Instl Svc: The investment seeks as high a level of current income as is consistent with preserving capital. The fund normally invests at least 80% of its net assets in a wide variety of investment grade fixed-income securities, such as corporate bonds, U.S. government securities, mortgage-backed securities, asset-backed securities and commercial paper. It may invest in high-yield bonds, as well as foreign government and corporate bonds that are denominated in U.S. dollars. The subadviser typically maintains an average portfolio duration that is up to one year greater than or less than the average portfolio duration of the Bloomberg U.S. Aggregate Bond Index. Performance as of 6/30/2024: 1 year: 2.83%; 3 years: -3.70%; 5 years: -0.63%; 10 years: 1.08%. As of most recent prospectus, total expense ratio is 0.59%, and net expense ratio is 0.52%.

Nationwide Loomis Core Bond Instl Svc: The investment seeks total return through investments in fixed-income securities. The fund invests primarily in bonds (or fixed-income securities) which include: U.S. government securities; corporate bonds issued by U.S. or foreign companies that are investment grade; investment grade fixed-income securities backed by the interest and principal payments of various types of mortgages, known as mortgage-backed securities and investment grade fixed-income securities backed by the interest and principal payments on loans for other types of assets. Performance as of 6/30/2024: 1 year: 3.47%; 3 years: -2.88%; 5 years: 0.03%; 10 years: 1.39%. As of most recent prospectus, total expense ratio is 0.73%, and net expense ratio is 0.73%.

Principal Core Fixed Income A: The investment seeks to provide a high level of current income consistent with preservation of capital. The fund invests primarily in a diversified pool of investment-grade fixed-income securities, including corporate securities, U.S. government securities, asset-backed securities and mortgage-backed securities. It maintains an average portfolio duration that is within ±25% of the duration of the Bloomberg U.S. Aggregate Bond Index. Performance as of 6/30/2024: 1 year: 2.56%; 3 years: -3.20%; 5 years: -0.26%; 10 years: 1.23%. As of most recent prospectus, total expense ratio is 0.76%, and net expense ratio is 0.76%.

Russell Inv Short Duration Bond S: The investment seeks to provide current income and preservation of capital with a focus on short duration securities. The fund has a non-fundamental policy to invest, under normal circumstances, at least 80% of the value of its net assets plus borrowings for investment purposes in bonds. Russell Investment Management, LLC provides or oversees the provision of all investment advisory and portfolio management services for the fund. It invests principally in short duration bonds and defines short duration as a duration ranging from 0.5 to 3.0 years. Performance as of 6/30/2024: 1 year: 5.55%; 3 years: 0.27%; 5 years: 1.39%; 10 years: 1.56%. As of most recent prospectus, total expense ratio is 0.70%, and net expense ratio is 0.54%.

T. Rowe Price New Income: The investment seeks to maximize total return through income and capital appreciation. The fund will invest at least 80% of its net assets in income-producing securities, which may include, but are not limited to, U.S. government and agency obligations, mortgage- and asset-backed securities (including commercial mortgage-backed securities), corporate bonds, foreign bonds, and Treasury inflation protected securities. Performance as of 6/30/2024: 1 year: 2.27%; 3 years: -3.70%; 5 years: -0.79%; 10 years: 0.98%. As of most recent prospectus, total expense ratio is 0.53%, and net expense ratio is 0.44%.

T. Rowe Price Short-Term Bond: The investment seeks a high level of income consistent with minimal fluctuation in principal value and liquidity. The fund will invest in a diversified portfolio of short- and intermediate-term investment-grade corporate, government, and asset- and mortgage-backed securities. It may also invest in money market securities, bank obligations, collateralized mortgage obligations, and foreign securities, including securities of issuers in emerging markets. The fund will invest at least 80% of its net assets (including any borrowings for investment purposes) in bonds. Its average effective maturity will normally not exceed three years. Performance as of 6/30/2024: 1 year: 5.38%; 3 years: 0.54%; 5 years: 1.51%; 10 years: 1.51%. As of most recent prospectus, total expense ratio is 0.46%, and net expense ratio is 0.46%.

Vanguard Short-Term Investment-Grade Inv: The investment seeks to provide current income while maintaining limited price volatility. The fund invests in a variety of high-quality and medium-quality fixed income securities, at least 80% of which will be short- and intermediate-term investment-grade securities. High-quality fixed income securities are those rated the equivalent of A3 or better; medium-quality fixed income securities are those rated the equivalent of Baa1, Baa2, or Baa3. Performance as of 6/30/2024: 1 year: 5.92%; 3 years: 0.27%; 5 years: 1.53%; 10 years: 1.84%. As of most recent prospectus, total expense ratio is 0.20%, and net expense ratio is 0.20%.

Additional Important Disclosures

This Commentary is for informational and discussion purposes only and does not constitute, and should not be construed as, an offer or solicitation for the purchase or sale of any securities, products or services discussed, and neither does it provide investment advice. Any such offer or solicitation shall only be made pursuant to the Fund’s Prospectus, which supersedes the information contained herein in its entirety.

The views expressed herein and any forward-looking statements are as of the date of the publication and are those of the portfolio management team. Future events or results may vary significantly from those expressed and are subject to change at any time in response to changing circumstances and industry developments. This information and data has been prepared from sources believed reliable, but the accuracy and completeness of the information cannot be guaranteed and is not a complete summary or statement of all available data. You should not construe the contents of this document as legal, tax, accounting, investment or other advice or recommendations.

You should consider the FPA New Income Fund’s (the “Fund”) investment objectives, risks, and charges and expenses carefully before you invest. The Prospectus for the Fund details the Fund’s objective and policies, charges, and other matters of interest to the prospective investor. Please read the Fund’s Prospectus carefully before investing. The Prospectus for the Fund may be obtained by visiting the website at fpa.com, by email at [email protected], toll-free by calling 1-800-982-4372 or by contacting the Fund in writing.

Abhijeet Patwardhan has been portfolio manager for the Fund since November 2015. Thomas Atteberry managed/co-managed the Fund from November 2004 through June 2022. Effective July 1, 2022, Mr. Atteberry transitioned to a Senior Advisory role. There were no material changes to the investment process due to this transition. Effective September 30, 2023, Mr. Atteberry no longer acts as a Senior Advisor to the investment team, but he remains as Senior Advisor to FPA.

Effective July 28, 2023, FPA New Income, Inc. was reorganized into the FPA Funds Trust and its new name is FPA New Income Fund. There was no change in its investment objective, investment strategy or fundamental investment policies. FPA continues to be the adviser to the Fund. For more information, please refer to the announcement on FPA’s website at: https://fpa.com/news-special-commentaries/fund-announcements/2023/06/26/fpa-announces-fund-reorganizations. Effective January 10, 2024, the FPA Funds Trust was renamed to the Investment Managers Series Trust III.

Portfolio composition will change due to ongoing management of the Fund. References to individual securities or sectors are for informational purposes only and should not be construed as recommendations by the Fund, the portfolio manager, the Adviser, or the distributor. It should not be assumed that future investments will be profitable or will equal the performance of the security or sector examples discussed. The portfolio holdings as of the most recent quarter-end may be obtained at fpa.com.

The statements made herein may be forward-looking and/or based on current expectations, projections, and/or information currently available. Actual results may differ from those anticipated. The portfolio manager and/or FPA cannot assure future results and disclaims any obligation to update or alter any statistical data and/or references thereto, as well as any forward-looking statements, whether as a result of new information, future events, or otherwise. Such statements may or may not be accurate over the long-term.

Investments, including investments in mutual funds, carry risks and investors may lose principal value. Capital markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. The Fund may purchase foreign securities, including depository receipts, which are subject to interest rate, currency exchange rate, economic and political risks; these risks may be elevated when investing in emerging markets. Foreign investments, especially those of companies in emerging markets, can be riskier, less liquid, harder to value, and more volatile than investments in the United States. The securities of smaller, less well-known companies can be more volatile than those of larger companies.

The return of principal in a bond fund is not guaranteed. Bond funds have the same issuer, interest rate, inflation and credit risks that are associated with underlying bonds owned by the Fund. Lower rated bonds, convertible securities and other types of debt obligations involve greater risks than higher rated bonds.

Interest rate risk is the risk that when interest rates go up, the value of fixed income instruments, such as bonds, typically go down and investors may lose principal value. Credit risk is the risk of loss of principal due to the issuer’s failure to repay a loan. Generally, the lower the quality rating of a fixed income instrument, the greater the risk that the issuer will fail to pay interest fully and return principal in a timely manner. If an issuer defaults, the fixed income instrument may lose some or all of its value.

Mortgage securities and collateralized mortgage obligations (CMOs) are subject to prepayment risk and the risk of default on the underlying mortgages or other assets; such derivatives may increase volatility. Convertible securities are generally not investment grade and are subject to greater credit risk than higher-rated investments. High yield securities can be volatile and subject to much higher instances of default.

Collateralized debt obligations (“CDOs”), which include collateralized loan obligations (“CLOs”), collateralized bond obligations (“CBOs”), and other similarly structured securities, carry additional risks in addition to interest rate risk and default risk. This includes, but is not limited to: (i) distributions from the underlying collateral may not be adequate to make interest or other payments; (ii) the quality of the collateral may decline in value or default; and (iii) the complex structure of the security may not be fully understood at the time of investment and may produce disputes with the issuer or unexpected investment results. Investments in CDOs are also more difficult to value than other investments.

Value style investing presents the risk that the holdings or securities may never reach their full market value because the market fails to recognize what the portfolio management team considers the true business value or because the portfolio management team has misjudged those values. In addition, value style investing may fall out of favor and underperform growth or other styles of investing during given periods.

The ratings agencies that provide ratings are the Nationally Recognized Statistical Ratings Organizations (NRSROs) DBRS, Inc., Fitch Ratings, Inc., Kroll Bond Rating Agency, Inc., Moody’s Investors Service, Inc., and S&P Global Ratings. Credit ratings range from AAA (highest) to D (lowest). Bonds rated BBB or above are considered investment grade. Credit ratings of BB and below are lower-rated securities (junk bonds). High-yielding, non-investment grade bonds (junk bonds) involve higher risks than investment grade bonds. Bonds with credit ratings of CCC or below have higher default risk.

Please refer to the Fund’s Prospectus for a complete overview of the primary risks associated with the Fund.

Index / Category Definitions

Comparison to any index is for illustrative purposes only and should not be relied upon as a fully accurate measure of comparison. Indices are unmanaged, do not reflect any commissions, fees or expenses which would be incurred by an investor purchasing the underlying securities. The Fund does not include outperformance of any index or benchmark in its investment objectives. Investors cannot invest directly in an index.

Bloomberg U.S. Aggregate Bond Index measures the performance of the U.S. investment grade bonds market, which includes investment grade U.S. Government bonds, investment grade corporate bonds, mortgage pass-through securities and asset-backed securities that are publicly offered for sale in the United States. The securities in the Index must have at least 1-year remaining in maturity. In addition, the securities must be denominated in U.S. dollars and must be fixed rate, nonconvertible, and taxable.

Morningstar Short-term Bond Category portfolios invest primarily in corporate and other investment-grade U.S. fixed-income issues and typically have durations of 1.0 to 3.5 years. These portfolios are attractive to fairly conservative investors, because they are less sensitive to interest rates than portfolios with longer durations. Morningstar calculates monthly breakpoints using the effective duration of the Morningstar Core Bond Index in determining duration assignment. Short-term is defined as 25% to 75% of the three-year average effective duration of the Morningstar Core Bond Index. As of June 30, 2024, there were 572 funds in this category.

Morningstar Intermediate-term Core Bond Category portfolios invest primarily in investment-grade U.S. fixed-income issues including government, corporate, and securitized debt, and hold less than 5% in below-investment-grade exposures. As of June 30, 2024, there were 471 funds in this category.

©2024 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted by Morningstar to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

The FPA Funds are distributed by UMB Distribution Services, LLC, (“UMBDS”), 235 W. Galena Street, Milwaukee, WI, 53212. UMB is not affiliated with FPA.