You should consider the Fund’s investment objectives, risks, and charges and expenses carefully before you invest. The Prospectus details the Fund’s objective and policies and other matters of interest to the prospective investor. Please read the Prospectus carefully before investing. The Prospectus may be obtained by visiting the website at fpa.com, by calling toll-free, 1-800-982-4372, or by contacting the Fund in writing.

Average Annual Total Returns (%)

Index data source: Morningstar.

Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. This data represents past performance and investors should understand that investment returns and principal values fluctuate, so that when you redeem your investment it may be worth more or less than its original cost. Current month-end performance data, which may be lower or higher than the performance data quoted, may be obtained at fpa.com or by calling toll-free, 1- 800-982-4372. The FPA Crescent Fund – Institutional Class (“Fund” or “FPACX”) total expense ratio as of most recent prospectus is 1.06%, net expense ratio is 1.06% (including dividend and interest expense on short sales), and adjusted expense ratio is 1.05% (after reimbursement and excluding dividend and interest expense on short sales).

Periods greater than one year are annualized. Fund performance is shown net of all fees and expenses. Fund performance is calculated on a total return basis which includes reinvestment of all distributions. Fund returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares, which would lower these figures. Comparison to any index is for illustrative purposes only. An investor cannot invest directly in an index. The Fund does not include outperformance of any index or benchmark in its investment objectives.

* The Fund commenced operations on June 2, 1993. The performance shown for periods prior to March 1, 1996 reflects the historical performance of a predecessor fund. FPA assumed control of the predecessor fund on March 1, 1996. The Fund’s objectives, policies, guidelines, and restrictions are, in all material respects, equivalent to those of the predecessor fund.

** The MSCI ACWI was not considered a relevant illustrative index prior to 2011 because the Fund was not classified as having global mandate until this point in time. Market Cycle Performance for MSCI ACWI is shown for illustrative purposes only in the most recently completed market cycle (i.e., 10/10/07-01/03/22) to illustrate how global equities performed during that period.

Market Cycle Performance is defined as a period that contains a decline of at least 20% from the previous market peak over at least a two-month period and a rebound to establish a new peak above the prior market peak. Data reflects the three most recent market cycles (peak to peak). The current cycle is ongoing and thus presented through the most recent quarter-end. Once the cycle closes, the results presented may differ materially.

First Pacific Advisors, LP (the “Adviser” or “FPA”), the Fund’s investment adviser, has contractually agreed to reimburse the Fund for operating expenses in excess of 0.05% of the average net assets of the Fund, excluding management fees, administrative service fees, short sale dividend expenses and interest expenses on cash deposits relating to short sales, brokerage fees and commissions, redemption liquidity service expenses, interest, taxes, fees and expenses of other funds in which the Fund invests, and extraordinary expenses, including litigation expenses not incurred in the Fund’s ordinary course of business, through April 30, 2026. The Adviser has also contractually agreed to reimburse the Fund for redemption liquidity service expenses in excess of 0.0044% of the average net assets of the Fund through April 30, 2026. These agreements may only be terminated earlier by the Fund’s Board of Trustees (the “Board”) or upon termination of the Advisory Agreement. Note that the management fees include both an advisory fee of 0.93% and class-specific administrative service fee of 0.07%. For additional information about the administrative service fee, please see the section in the Prospectus titled “Management of the Fund.”

All data herein is representative of the Institutional Share Class. Please see important disclosures at the end of this commentary.

Dear Shareholder:

Performance Overview

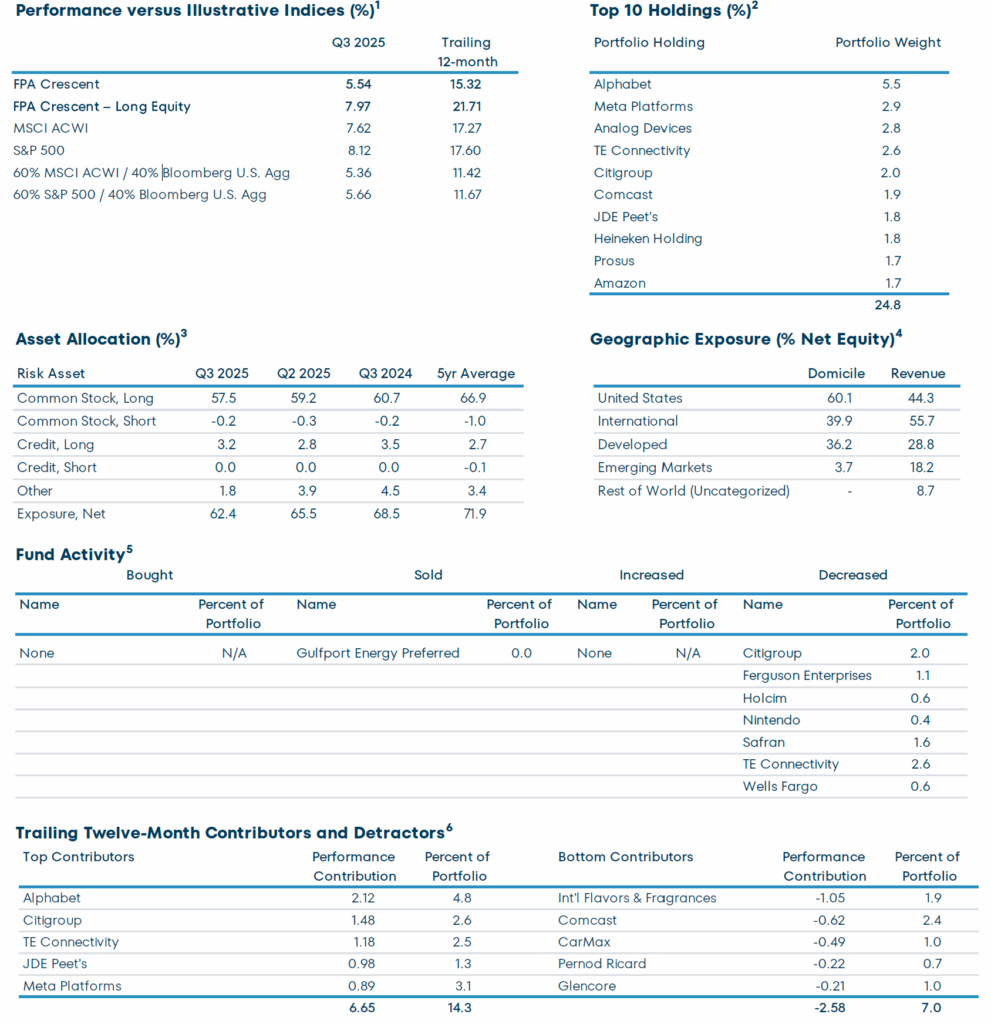

The FPA Crescent Fund – Institutional Class (“Fund” or “Crescent”) gained 5.54% in Q3 2025 and 15.32% in the trailing twelve months.

Its twelve-month return was 88.7% of the global market (i.e., MSCI AWCI, the “ACWI”), outperforming its 65.4% average net risk exposure during the same period.

Performance versus Illustrative Indices (%)1

| Q3 2025 | Trailing 12-month | |

|---|---|---|

| FPA Crescent | 5.54 | 15.32 |

| FPA Crescent – Long Equity | 7.97 | 21.71 |

| MSCI ACWI | 7.62 | 17.27 |

| S&P 500 | 8.12 | 17.60 |

| 60% MSCI ACWI / 40% Bloomberg U.S. Agg | 5.36 | 11.42 |

| 60% S&P 500 / 40% Bloomberg U.S. Agg | 5.66 | 11.67 |

1 Source: FPA, Morningstar. Comparison to the indices is for illustrative purposes only. The Fund does not include outperformance of any index or benchmark in its investment objectives. An investor cannot invest directly in an index. The long equity segment of the Fund is presented gross of investment management fees, transactions costs, and Fund operating expenses, which if included, would reduce the returns presented. Long equity holdings only includes equity securities excluding paired trades, short-sales, and preferred securities. The long equity performance information shown herein is for illustrative purposes only and may not reflect the impact of material economic or market factors. No representation is being made that any account, product, or strategy will or is likely to achieve profits, losses, or results similar to those shown. Long equity performance does not represent the return an investor in the Fund can or should expect to receive. Fund shareholders may only invest or redeem their shares at net asset value.

Portfolio & Market Discussion

Crescent’s top five performers contributed 6.65% to its trailing twelve-month return while its bottom five detracted 2.58%.

Trailing Twelve-Month Top and Bottom Contributors (%) as of September 30, 20252

| Top Contributors | Performance Contribution | Percent of Portfolio | Bottom Contributors | Performance Contribution | Percent of Portfolio |

|---|---|---|---|---|---|

| Alphabet | 2.12 | 4.8 | Int’l Flavors & Fragrances | -1.05 | 1.9 |

| Citigroup | 1.48 | 2.6 | Comcast | -0.62 | 2.4 |

| TE Connectivity | 1.18 | 2.5 | CarMax | -0.49 | 1.0 |

| JDE Peet’s | 0.98 | 1.3 | Pernod Ricard | -0.22 | 0.7 |

| Meta Platforms | 0.89 | 3.1 | Glencore | -0.21 | 1.0 |

| 6.65 | 14.3 | -2.58 | 7.0 |

2 Reflects the top five contributors and detractors to the Fund’s performance based on contribution to return for the trailing twelve months (“TTM”). Contribution is presented gross of investment management fees, transactions costs, and Fund operating expenses, which if included, would reduce the returns presented. Percent of portfolio reflects the average position size over the period. The information provided does not reflect all positions purchased, sold or recommended by FPA during the quarter. A copy of the methodology used and a list of every holding’s contribution to the overall Fund’s performance during the TTM is available by contacting FPA Client Service at [email protected]. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of the securities listed.

We will review the following companies that have impacted portfolio performance but that we have not recently discussed.³

Despite anxiety about Alphabet’s future that has colored investors’ views of the company, its stock price has risen seventeen-fold since our initial purchases in 2011. Recent concerns include competitive threats in search, stemming from competing AI models, as well as antitrust scrutiny in the US and Europe. Additionally, there is an open question about the likely return on the billions spent on moonshot investments, among other issues. Its stock has risen 28% year-to-date and 57% since the end of Q1, when it was one of the Fund’s larger performance detractors in the trailing-twelve-month period, mainly due to a judge’s Q3 ruling that declined to force a breakup of Chrome and Android. While legal and competitive challenges persist, Alphabet continues to enhance its existing search offering with new AI features that have been well-received and are continually evolving. Meanwhile, YouTube is now the most-watched media outlet on the planet, with more than one trillion hours of video viewed, and arguably remains under monetized. We expect its cloud offering to continue to grow and eventually achieve the higher margins of its larger peers. Furthermore, the value of Waymo’s leading self-driving technology is evident to those of us at FPA who have experienced its autonomous ride-share service, and its bright future is likely not fully reflected in its stock price. The Fund therefore continues to maintain a position in Alphabet, although we have sold some shares over time.

Citigroup has improved its return on tangible equity (ROTE) compared to industry peers. In addition, regulatory changes in the US have increased the normal level of ROTE for US-based banks. The combination of a low starting valuation, demonstrated operating improvement, and an improved regulatory environment have resulted in strong share-price performance over the past twelve months.

JDE Peet’s is a pure-play coffee and tea company, with a presence in over 100 markets and a portfolio of 50+ brands. Following a period of material underperformance, JDE Peet’s changed management and agreed to be acquired by Keurig Dr. Pepper. The combination of improved management and agreement to sell the business led to strong performance over the past twelve months.

International Flavors & Fragrances (IFF) is a leading producer of ingredients for food, beverage, personal care, health, and household products industries. Its products are ubiquitous across many household staples, including the enzyme used in half of cold-water laundry detergents, another enzyme used in one-fifth of the global beer market, and one-third of yogurts use an IFF culture. IFF has faced challenges: its prior management was unfortunately reckless in capital allocation, making poor acquisitions and failing to manage its diverse global enterprise effectively. This transformed a high-margin, unlevered company into one with a lower margin and greater leverage. However, a new CEO has renewed the company’s focus on being best-in-class operationally, with a smaller suite of products. IFF has sold and is expected to continue to sell non-core assets, which would decrease the firm’s leverage and likely improving margins. The company has burned investors, leading many to adopt a wait-and-see attitude. IFF’s current ~$4 of free cash flow could increase to $5-6 in a few years, and if successful, its P/E ratio should also rise to be more in line with its peers. With its stock currently at $61, we don’t see much downside and, should IFF execute well, we can reasonably see a path to the stock price doubling over the next few years (inclusive of its free cash flow).⁴

CarMax, the largest retailer of used cars in the US, has been a disappointment. We entered 2025 with hopes that an improved omnichannel offering in an improving used vehicle market would drive increased sales volumes, market share, and profit growth. Instead, we’ve watched management make a series of missteps. The company withdrew its 2030 unit sales targets at the beginning of the year, citing tariff-related uncertainty expected to have little impact five years from now—not particularly confidence-boosting, especially when their competitors retained their stated medium-term goals. Management mistakenly expected their strong fiscal first quarter to continue. They overbought inventory at elevated prices, which they were then forced to work through in the second quarter, causing them to lose market share. Investors have punished the company for its mistakes, and shares have declined by 47% year to date. Despite our disappointment in management’s execution, the company’s share price appears inexpensive to us. CarMax trades for roughly 12x forward consensus earnings and 1.1x tangible book value. Two independent directors bought shares in early October, seemingly supporting that view. The company also increased its share repurchase program, though we wish they would have held off on repurchases until the market was aware of the current disappointing news. We still believe that CarMax has built a differentiated used vehicle retail business and could see substantial share price improvement if the company rights itself, but operational execution needs to significantly improve.

3 Historical commentaries for the Fund can be accessed here on the fpa.com website.

Past performance is no guarantee, nor is it indicative, of future results.

4 Relates to IFF: Projections on consensus future free cash earnings are based on FPA’s analysis of the last 12 months’ actual and forward-looking consensus estimates. FPA has applied a range of $5.50-6.00 for free cash earnings based on forward-looking free cash earnings, which is lower than the current consensus for those same periods. Based on these three inputs ((a) consensus future free cash flow earnings, (b) conservative P/E metrics relative to IFF’s peer group, and (c) FPA analysis based on IFF company financials), FPA believes that it is possible that the IFF stock price could double in the next few years. Although we believe this estimate has a reasonable basis, it is hypothetical and not guaranteed.

Closing

While the world changes around us and investors’ interpretations of those shifts swing markets, we maintain a continuity that has been our hallmark for more than three decades. As Robert Plant sang, “The Song Remains the Same.” Day in and day out, our research team seeks to improve our understanding of the best global businesses while selectively conducting work on more episodic commercial opportunities. We look forward to sharing a more detailed view of our portfolio positioning and the factors that influence it in our year-end commentary. Until then.

Respectfully submitted,

FPA Crescent Portfolio Managers

October 28, 2025

FPA Crescent Fund Portfolio Highlights

All data on this page as of September 30, 2025 and is for the FPA Crescent Fund – Institutional Class, unless otherwise indicated.

Source: Factset, Morningstar, Bloomberg, FPA.

Please see footnote references in the following page. Portfolio composition will change due to ongoing management of the Fund. Past performance is no guarantee, nor is it indicative, of future results. Please see the end of this Commentary for important disclosures and definitions.

FPA Crescent Fund Portfolio Highlights Footnotes

1 Source: FPA, Morningstar. Comparison to the indices is for illustrative purposes only. The Fund does not include outperformance of any index or benchmark in its investment objectives. An investor cannot invest directly in an index. The long equity segment of the Fund is presented gross of investment management fees, transactions costs, and Fund operating expenses, which if included, would reduce the returns presented. Long equity holdings only includes equity securities excluding paired trades, short-sales, and preferred securities. The long equity performance information shown herein is for illustrative purposes only and may not reflect the impact of material economic or market factors. No representation is being made that any account, product, or strategy will or is likely to achieve profits, losses, or results similar to those shown. Long equity performance does not represent the return an investor in the Fund can or should expect to receive. Fund shareholders may only invest or redeem their shares at net asset value.

2 List provides the top 10 holdings for the Fund as a percentage of total net assets.

3 Risk Assets include all investments excluding cash and cash equivalents. Net Risk Exposure is the percentage of portfolio exposed to Risk Assets. “Other” includes derivatives, futures, limited partnerships, and US Treasuries with maturity greater than 1 year.

4 Geographic exposure based on country of domicile and revenue by geography. Revenue refers to the geographic location of companies’ revenue sources, rather than where they are domiciled, and may provide insight into the portfolio’s geographic diversification. Domicile and revenue composition are shown for the FPA Crescent Fund – Institutional Class’s (“Fund”) net equity positions as of June 30, 2025. Portfolio composition will change due to ongoing management of the Fund. Excludes cash and cash equivalents.

5 The information provided does not reflect all positions purchased, sold or recommended by FPA during the quarter. The Bought/Sold table excludes positions used for cash management and positions that have not been explicitly identified in the fund’s most recent quarterly portfolio holdings report. It should not be assumed that an investment in the securities listed was or will be profitable. Increases and decreases represent securities whose position size either changed by at least 33% over the period and that represented greater than 0.75% of the portfolio at the beginning of the quarter or approximately greater than 0.25% of average NAV spent on trading. Percent of portfolio reflects the ending position size of the period. The portfolio holdings as of the most recent quarter-end may be obtained at fpa.com.

6 Reflects the top five contributors and detractors to the Fund’s performance based on contribution to return for the trailing twelve months (“TTM”). Contribution is presented gross of investment management fees, transactions costs, and Fund operating expenses, which if included, would reduce the returns presented. Percent of portfolio reflects the average position size over the period. The information provided does not reflect all positions purchased, sold or recommended by FPA during the quarter. A copy of the methodology used and a list of every holding’s contribution to the overall Fund’s performance during the TTM is available by contacting FPA Client Service at [email protected]. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of the securities listed.

Important Information

This Commentary is for informational and discussion purposes only and does not constitute, and should not be construed as, an offer or solicitation for the purchase or sale with respect to any securities, products or services discussed, and neither does it provide investment advice. Any such offer or solicitation shall only be made pursuant to the Fund’s Prospectus, which supersedes the information contained herein in its entirety. This presentation does not constitute an investment management agreement or offering circular.

Any views expressed herein and any forward-looking statements are as of the date of the publication, are those of the portfolio management team, and are subject to change without notice. Future events or results may vary significantly from those expressed and are subject to change at any time in response to changing circumstances and industry developments. This information and data have been prepared from sources believed reliable, but the accuracy and completeness of the information cannot be guaranteed and is not a complete summary or statement of all available data. All information and data is as of the date of this commentary unless otherwise disclosed.

Portfolio composition will change due to ongoing management of the Fund. References to individual securities or sectors are for informational purposes only and should not be construed as recommendations by the Fund, the portfolio managers, the Adviser, or the distributor. It should not be assumed that future investments will be profitable or will equal the performance of the security or sector examples discussed. The portfolio holdings as of the most recent quarter-end may be obtained at fpa.com.

Investments carry risks and investors may lose principal value. Capital markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. The Fund may purchase foreign securities, including American Depository Receipts (ADRs) and other depository receipts, which are subject to interest rate, currency exchange rate, economic and political risks; these risks may be heightened when investing in emerging markets. Foreign investments, especially those of companies in emerging markets, can be riskier, less liquid, harder to value, and more volatile than investments in the United States. Adverse political and economic developments or changes in the value of foreign currency can make it more difficult for the Fund to value the securities. Differences in tax and accounting standards, difficulties in obtaining information about foreign companies, restrictions on receiving investment proceeds from a foreign country, confiscatory foreign tax laws, and potential difficulties in enforcing contractual obligations, can all add to the risk and volatility of foreign investments.

Small and mid-cap stocks involve greater risks and may fluctuate in price more than larger company stocks. Short-selling involves increased risks and transaction costs. You risk paying more for a security than you received from its sale.

The return of principal in a bond investment is not guaranteed. Bonds have issuer, interest rate, inflation and credit risks. Interest rate risk is the risk that when interest rates go up, the value of fixed income securities, such as bonds, typically go down and investors may lose principal value. Credit risk is the risk of loss of principal due to the issuer’s failure to repay a loan. Generally, the lower the quality rating of a security, the greater the risk that the issuer will fail to pay interest fully and return principal in a timely manner. If an issuer defaults the security may lose some or all of its value. Lower rated bonds, callable bonds and other types of debt obligations involve greater risks. Mortgage-backed securities and asset-backed securities are subject to prepayment risk and the risk of default on the underlying mortgages or other assets. High yield securities can be volatile and subject to much higher instances of default. Derivatives may increase volatility.

The ratings agencies that provide ratings are Standard and Poor’s, Moody’s, Fitch, DBRS, Kroll, and any other nationally recognized statistical rating organization (“NRSRO”). Credit ratings range from AAA (highest) to D (lowest). Bonds rated BBB or above are considered investment grade. Credit ratings BB and below are lower-rated securities (junk bonds). High-yielding, non-investment grade bonds (junk bonds) involve higher risks than investment grade bonds. Bonds with credit ratings of CCC or below have high default risk.

Value securities, including those selected by the Fund’s portfolio managers, are subject to the risk that their intrinsic value may never be realized by the market because the market fails to recognize what the portfolio managers consider to be their true business value or because the portfolio managers have misjudged those values. In addition, value style investing may fall out of favor and underperform growth or other styles of investing during given periods.

While transactions in derivatives may reduce certain risks, they entail certain other risks. Derivatives may magnify the Fund’s gains or losses, causing it to make or lose substantially more than it invested. Derivatives have a risk of default by the counterparty to a contract. When used for hedging purposes, increases in the value of the securities the Fund holds or intends to acquire should offset any losses incurred with a derivative.

Investments in private securities and limited partnerships present risks. These investments are not registered under the federal securities laws and are generally eligible for sale only to certain eligible investors. They may be illiquid, and thus more difficult to sell, because there may be relatively few potential purchasers for such investments, and the sale of such investments may also be restricted under securities laws.

Please refer to the Fund’s Prospectus for a complete overview of the primary risks associated with the Fund.

In making any investment decision, you must rely on your own examination of the Fund, including the risks involved in an investment. Investments mentioned herein may not be suitable for all recipients and in each case, potential investors are advised not to make any investment decision unless they have taken independent advice from an appropriately authorized advisor. An investment in any security mentioned herein does not guarantee a positive return as securities are subject to market risks, including the potential loss of principal. You should not construe the contents of this document as legal, tax, investment or other advice or recommendations

Index Definitions

Comparison to any index is for illustrative purposes only and should not be relied upon as a fully accurate measure of comparison. The Fund may be less diversified than the indices noted herein, and may hold non-index securities or securities that are not comparable to those contained in an index. Indices will hold positions that are not within the Fund’s investment strategy. Indices are unmanaged and do not reflect any commissions, transaction costs, or fees and expenses which would be incurred by an investor purchasing the underlying securities and which would reduce the performance in an actual account. You cannot invest directly in an index. The Fund does not include outperformance of any index in its investment objectives.

60% MSCI ACWI/40% Bloomberg U.S. Aggregate Index is a hypothetical combination of unmanaged indices comprised of 60% MSCI ACWI Index and 40% Bloomberg U.S. Aggregate Bond Index. Consumer Price Index (CPI) is an unmanaged index representing the rate of inflation of the U.S. consumer prices as determined by the U.S. Department of Labor Statistics. There can be no guarantee that the CPI or other indices will reflect the exact level of inflation at any given time.

60% S&P 500/40% Bloomberg U.S. Aggregate Index is a hypothetical combination of unmanaged indices comprised of 60% S&P 500 Index and 40% Bloomberg U.S. Aggregate Bond Index.

Bloomberg U.S. Aggregate Bond Index provides a measure of the performance of the U.S. investment grade bonds market, which includes investment grade U.S. Government bonds, investment grade corporate bonds, mortgage pass-through securities and asset-backed securities that are publicly offered for sale in the United States. The securities in the Index must have at least 1-year remaining in maturity. In addition, the securities must be denominated in U.S. dollars and must be fixed rate, nonconvertible, and taxable.

MSCI ACWI NR USD Index (MSCI ACWI) is an unmanaged free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. Net Return (NR) indicates that withholding taxes are applied to dividend reinvestments. MSCI uses withholding tax rates applicable to Luxembourg holding companies.

MSCI China Index captures large and mid-cap representation across China A shares, H shares, B shares, Red chips, P chips and foreign listings (e.g. ADRs).

MSCI Emerging Markets Index captures large and mid-cap representation across emerging markets countries. The index covers approximately 85% of the free float-adjusted market capitalization in each country. Net Return (NR) indicates that withholding taxes are applied to dividend reinvestments. MSCI uses withholding tax rates applicable to Luxembourg holding companies.

MSCI Europe Index captures large and mid-cap representation across Developed Markets (DM) countries in Europe. DM countries in Europe include Austria, Belgium, Denmark, Finland, France, Germany, Ireland, Italy, the Netherlands, Norway, Portugal, Spain, Sweden, Switzerland and the UK.

MSCI Japan Index is designed to measure the performance of the large and mid-cap segments of the Japanese market.

Standard & Poor’s 500 Stock Index (S&P 500) is a capitalization-weighted index which covers industrial, utility, transportation and financial service companies, and represents approximately 75% of the New York Stock Exchange (NYSE) capitalization and 30% of NYSE issues. The S&P 500 is considered a measure of large capitalization stock performance.

Glossary of Terms

Average Net Risk exposure is calculated as a simple average of the portfolio’s Net Risk Exposure as measured at the end of each quarter.

Earnings Per Share (EPS) is calculated as a company’s profit divided by the number of its outstanding shares of its common stock. The resulting number serves as an indicator of a company’s profitability.

Earnings Yield refers to the earnings per share for the most recent 12-month period divided by the current market price per share. The earnings yield (the inverse of the P/E ratio) shows the percentage of a company’s earnings per share.

Forward Price to Earnings is a version of the price-to-earnings (P/E) that uses forecasted earnings for the P/E calculation.

Free Cash Flow represents the cash a company can generate after required investment to maintain or expand its asset base.

Long Equity Performance represents the performance of stocks that the Fund owned over the given time periods and excludes the long equity portion of a pair trade, short-sales, limited partnerships, derivatives/futures, corporate bonds, mortgage-backed securities, and cash and cash equivalents.

Market Capitalization refers to the total dollar market value of a company’s outstanding shares of stock.

Market Cycles, also known as stock market cycles, is a wide term referring to trends or patterns that emerge during different markets or business environments.

Net Equity Exposure includes long equity securities minus short-sales and preferred securities.

Price to Earnings is the ratio valuing a company that measures its current share price relative to its EPS. The price-to-earnings ratio is also sometimes known as the price multiple or earnings multiple.

Return on Tangible Equity (ROTE) is a financial profitability metric that measures a company’s earnings as a percentage of its tangible shareholders’ equity.

Risk Assets is any asset that carries a degree of risk. Risk asset generally refers to assets that have a significant degree of price volatility, such as equities, commodities, high-yield bonds, real estate, and currencies, but does not include cash and cash equivalents.

Standard Deviation is a measure of the dispersion of a set of data from its mean.

Tangible Book Value is a company’s total book value minus its intangible assets like goodwill and patents. It provides a more conservative estimate of a company’s net worth by excluding non-physical assets that may have little to no liquidation value.

Trailing Price to Earnings is a relative valuation multiple that is based on the last 12 months of actual earnings.

Volatility is a statistical measure of the dispersion of returns for a given security or market index. In most cases, the higher the volatility, the riskier the security. Volatility is often measured as either the standard deviation or variance between returns from that same security or market index.

©2025 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted by Morningstar to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

The FPA Funds are distributed by Distribution Services, LLC, 190 Middle Street, Suite 301, Portland, ME 04101. Distribution Services, LLC and FPA are not affiliated.